Budget 2022-23: A perspective

By Philip Mudartha

Bellevision Media Network

Preface:

On the 1st February 2022, Finance Minister (FM), Nirmala Sitharaman, unveiled the Union Budget for FY23.

As she spoke, a joke was circulating on WhatsApp.

Quote:

“11:00 AM - FM would rise to read her budget speech.

11:45 AM - Arnab Goswami would declare the budget as historic.

01:05 PM - Congress would declare the budget as disaster. CPI would declare budget as friendly to Ambani and Adani.

In the evening, the entire media would become the top economists of the world.

But at night, the common man would go to sleep without any difference as he has to go to work again tomorrow”.

Unquote.

I too slept the night away as I am neither a politician nor a media person. But I have been a keen watcher of budget speeches for decades. For me, the budget is nothing more than an annual book keeping exercise akin to what households do periodically. Most households earn more than what they spend, and save for the rainy days. But, the Government of India (GoI) spends more than it earns and borrows to fund the shortfall.

The Big Hole in GoI finances:

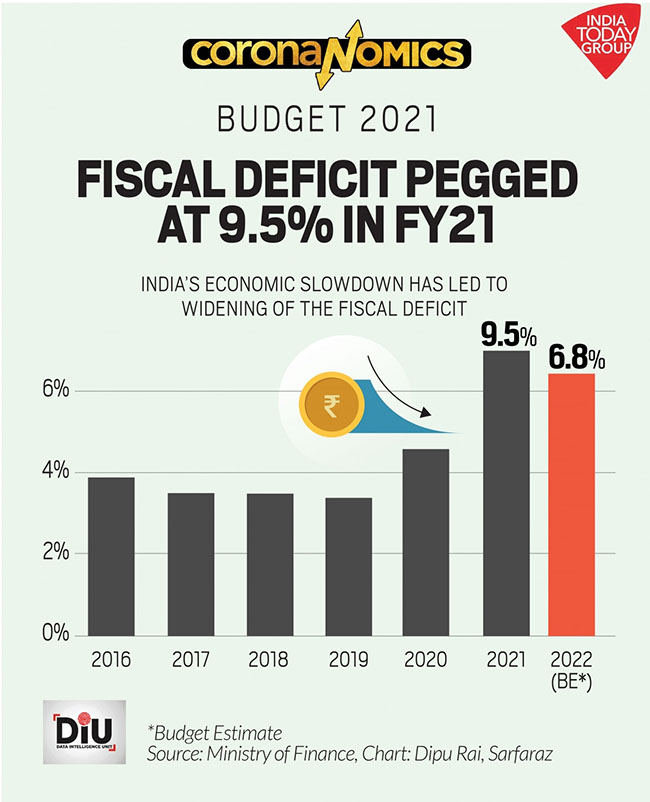

The FY23 budget estimates an expenditure of Rupees 39,44,909 crore. Of which, largest share of Rupees 9,40,651crore is the interest burden on its outstanding debt. Unfazed, the GoI aims to borrow more by a whopping Rupees 16,61,196 crore during the year. The outstanding debt and other liabilities of the GoI on 31st March 2023 will be Rupees 1,52,17,910 crore.

PM Modi promises a government with a difference: Minimum government, maximum governance. Did he walk the talk? On 31st March 2014, the total debt was Rupees 53,11,081 crore accumulated over 67 years. Within nine years, PM Modi would add almost twice as much: a whopping 99 lakh crore plus! This is Modinomics, in the best Keynesian tradition.

The Budget has a clear direction:

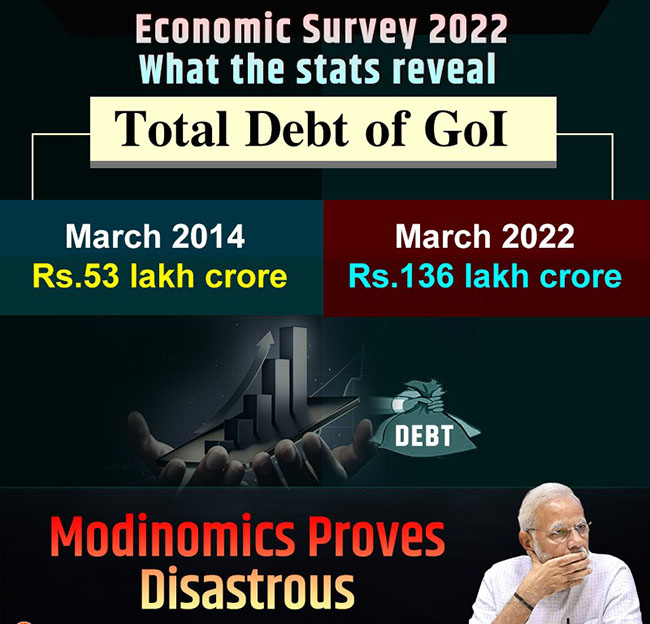

Borrow to spend on infrastructure with increased deficits; to hell with the fiscal discipline mandated by Financial Responsibility & Budget Management (FRBM) Act 2003.

The approach is not new. It is tried and tested for economic recovery. Roosevelt did it in the US to pull the country out of the 1938 recession. Not long ago, Government led spending and investment helped G20 economies recover from the 2007-09 financial crisis.

In India, the (then) FM (late) Pranab Mukherjee in the UPA-1 government too focused on infrastructure spending under the Bharat Nirman scheme with a massive injection of Rs 40,900 crore in FY2010. "In the current environment, there is a clear need for contra-cyclical policy and it calls for a substantial increase in expenditure in infrastructure development where we have a large gap and in rural development where the programs such as Bharat Nirman and MGNREGA are playing a vital social role," Mukherjee had said in his budget speech.

For FY2010, GoI had estimated fiscal deficit at 5.5% of GDP as against the mandate of 3%.

The Modi-2.0 is doing in 2022 what the UPA-1 did in 2009. The UPA-1 returned to power in 2009 general elections which is widely seen as endorsement of its economic policies. Modi aims to take a leaf from the UPA book with his eyes firmly set on upcoming assembly elections in key states and the 2024 general election.

Infrastructure is the budget focus:

The revised estimates of capital expenditure or capex for FY22 is Rupees 5,50,740 crore. The FY23 budget earmarks Rupees 7.50 lakh crore for capex, which is a rise of 36.2%. In absolute terms, the rise in capex is around Rupees 2 lakh crore.

Out of the increase, 1/3rd is allocated towards building highways through the Ministry of Road Transport and Highways, and almost all of it through the National Highways Authority of India (NHAI). The budget outlay for NHAI more than doubled to Rupees 1,34,015 crore. The government also hiked its allocation for building rural roads by nearly 36% to Rs 19,000 crore under the PM Gram Sadak Yojana (another signature scheme of UPA-1). So, its roads, roads and more roads. Nitin Gadkari, the most effective minister under Modi must be pleased!

The construction of highways and building village roads should ramp up demand for investment goods, which in turn should push up job creation and demand for labor. This would also spur demand for cement, steel, and other machinery related to building infrastructure.

Modi still believes in PSUs:

PM Modi has famously repeated his mantra: government has no business to be in business. However, his policies do not reflect his creed. This year’s budget allocation to Department of Telecom under the Ministry of Communication is increased by Rupees 48, 680 crores to Rupees 84, 587 crores. This signals that the state-run telecom operator BSNL will roll-out nation-wide 4G services during 2022 with a capex of Rupees 44,720 crores.

In other words, government under Modi has decided that BSNL should not be allowed to fail. The state-run telco might not deserve it after so much of losses and really poor performance, but so was the case of Air India which was making losses since its merger with Indian Airlines. The Turnaround Plan (TAP), as well as a Financial Restructuring Plan (FRP), were approved for Air India by the UPA regime in 2012 which proved to be failures. Now, Modi is set to implement TAP and FRP for BSNL and he expects that BSNL will succeed where Air India failed.

Budget Highlights:

Note 1: The subsidy bill for food during FY21 was one-off expenditure to feed the extremely poor who lost all means of livelihood owing to the lockdown. However, the general trend of government under Modi is to reduce all subsidies.

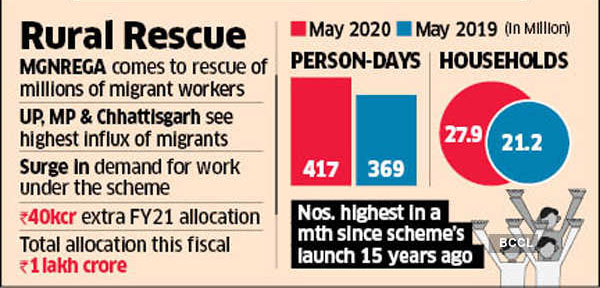

Note 2: MGNREGA is the signature scheme launched by UPA-1 government which aims to guarantee employment of 100 days in a year to the head of a rural household. Modi, a hardcore critic while in opposition, has found merits in the scheme and has not abolished it. But he has gradually tapered off the allocation of funds.

Note 3: A very ambitious target to raise Rupees 175,000 crore during FY22 was set which the Department of Investment and Public Asset Management (DIPAM) did not meet. Chastised by the failure, the DIPAM has set a modest target for FY23. It is likely to be realized through Initial Public Offer (IPO) of profit-making national insurer LIC of India.

The Selling of Family Silver:

The government is coy about “selling family silver” and uses terms like strategic disinvestment, asset monetization, public asset management etc. It gives an impression that “privatization” is a dirty word. If “borrowing from the market” is kosher to raise resources for the government spending, then “transferring equity in state-run PSUs to the market” should also be so.

For almost two years, India has steeled itself for a gargantuan task: readying the country’s premier insurer, the state-owned crown jewel, LIC of India for going public and listing its equity shares on the bourses. With $500 billion in assets and an estimated valuation of $203 billion, experts are calling the IPO of LIC as India’s Aramco moment. (Aramco is Saudi Arabia’s oil giant).

The government has already missed its own target of October 2021 to come out with the IPO. With model code of conduct to remain in force till 7th March 2022 because of assembly elections in five key states, the IPO of LIC may have to wait.

The government is eying a market valuation of at least Rupees sixteen lakh crores. That would place LIC as third biggest Indian company behind Reliance Industries and Tata Consultancy Services.

The government is mulling a 10% stake sale and attract small investors to the IPO. Advertisements are beamed with suggestion that its agents, policyholders and employees prepare for the IPO by opening demat accounts.

In lighter vein:

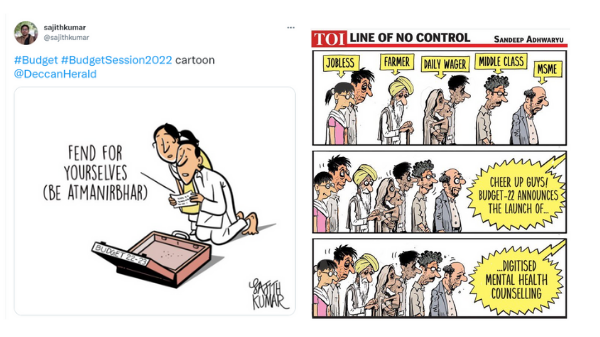

The Budget announced the roll-out of the national tele-mental health program under the leadership of NIMHANS and technology assistance of IIIT, Bengaluru. The cartoonists had a field day: refer to the above cartoon which sums up the mood of the common man succinctly!

Write Comment |

Write Comment |  E-Mail To a Friend |

E-Mail To a Friend |

Facebook |

Facebook |

Twitter |

Twitter |

Print

Print