Analysis: 2024-25 Union Budget (Chapter 2)

By Philip Mudartha, Navi Mumbai.

Bellevision Media Network

28 Jul 2024:

Preface:

I invited six of the regular readers of this column to co-author this chapter on positives of the FY 2024-25. Five declined and only Nandanan, Trissur said “yes”. I received his views through WhatsApp.

This is edited extracts of his message: “The annual rituals of budget presentation are boring but this time I had to go through it, because, there seems to be something that affects me too this time. If it’s not for the tweaking of Capital Gains Taxation, the budget is old wine in new bottle”.

“The new system on capital gains will help reducing black money. The buyer will pay the right stamp duty while registering the deed. The seller will pay the right tax on his capital gains. I find the online property transactions in US transparent where the government treasury is credited with applicable tax automatically. Neither the seller not the buyer will bother about the taxes”.

“Because the seller’s LTCG is taxed at 12.5% and can walk away with the larger pie of 87.5%, the proposed capital gains taxation system is a positive of the budget”.

I have dealt briefly but sufficiently about the proposed capital gains taxation system in the previous chapter. Therefore, I will not elaborate any further.

Budget Estimate of Fiscal Deficit:

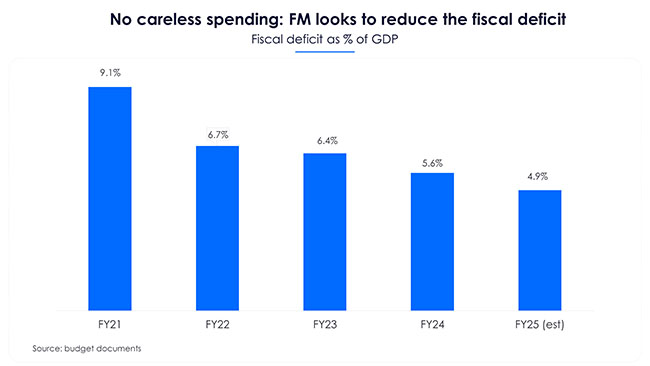

Let us begin from where we ended previous chapter and list the positives. At the macro-level, the FM has shown the Government of India’s (GoI) commitment to the financial consolidation path. In the interim budget unveiled in February 2024, the fiscal budget for FY 2024-25 was projected at 5.1% of GDP. In this full budget, it has been revised downwards to 4.9%. That’s is of course a positive.

No, do not clap your hands in applause of GoI. Not yet! Because a) The RBI gave it a record dividend of Rs 2.11 Lakh Crore (Previous year Rs 87,416 Crore) on 21st May 2024. b) The ECI enforced Model Code of Conduct were in force till 4th June 2024 due to LS elections. The hands of GoI were tied. It could not squander the surplus on “freebies”. Sorry FM, you could not spend carelessly even if you wanted to. So, two cheers to RBI and ECI.

Part -1: The Budget Highlights:

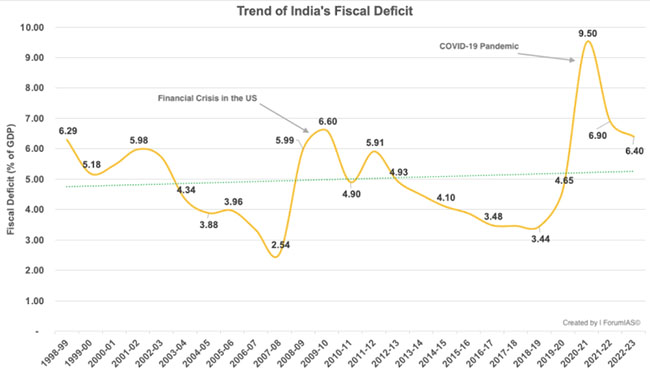

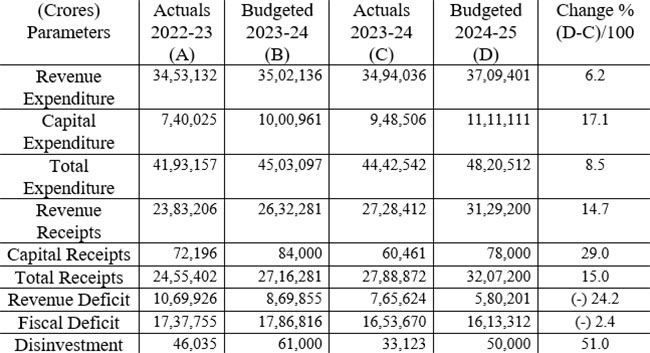

1. Expenditure: GoI estimates to spend Rs 48, 20,512 crore Rupees, 8.5% higher than the actual expenditure in 2023-24.

2. Interest payments account for 24% of the total expenditure, and 37% of revenue receipts.

3. Receipts: Other than borrowings, the GoI estimates to collect 32, 07,200 crore Rupees, 15% higher than the actual receipts in 2023-24.

4. Tax revenue is expected to increase by 11% over the actual receipts in 2023-24.

5. GDP: GoI estimates a nominal growth rate of 10.5% in 2024-25 (real growth plus inflation).

6. Deficits: Revenue deficit is targeted at 1.8% of GDP. This is lower than the actual revenue deficit of 2.6% of GDP in 2023-24.

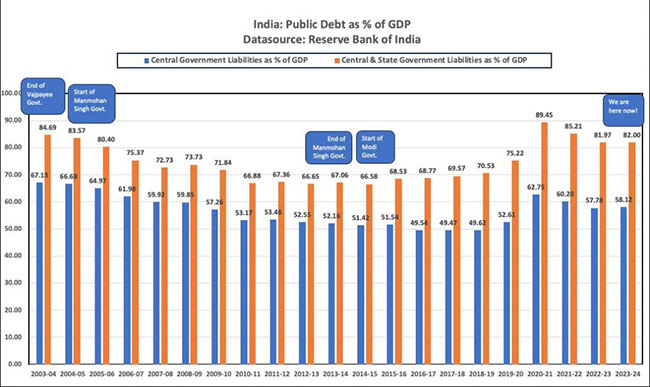

7. Fiscal deficit in 2024-25 is targeted at 4.9% of GDP, which is lower than the actual fiscal deficit of 5.6% of GDP in 2023-24 (refer to Chart above).

UPA- 1 was fiscally very prudent, thanks to lefties like CPM and CPI who were giving outside support. The 2008 financial crisis in the US battered fiscal prudence of UPA-1. The global COVID-19 pandemic from 2020-21 onwards battered Modi-2. (Refer to trend graph above).

Major Policy Highlights:

1. Employment: Three schemes to promote employment and increase workforce participation were announced. (a) Wage support up to Rs 15,000 to first time employees registered with EPFO, (b) incentives to employees and employers in the manufacturing sector for their EPFO contributions, and (c) reimbursement of up to Rs 3,000 per month for employer EPFO contributions, per new employee for two years.

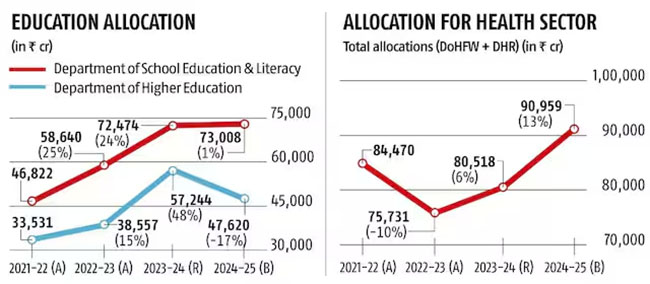

2. Skilling: A scheme to up-skill 20 lakh youth over five years will be launched. Under this, 1,000 industrial training institutes will be upgraded to meet the skilling needs of the industry.

3. Another scheme to provide internship opportunities for one crore youth in 500 top companies has been announced. Under this, a monthly allowance of Rs 5,000 and a one-time assistance of Rs 6,000 will be provided to the beneficiaries. Companies can bear the training cost and 10% of the internship cost from their CSR funds.

4. Assistance to states: Plan will be formulated to enhance human resources, infrastructure and economic opportunities in Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

5. Financial support of Rs 15,000 crore will be provided to Andhra Pradesh for a new capital this year.

6. Agriculture: Existing agricultural research setup will be reviewed with a focus on raising productivity and developing climate resilient crops. Vegetable production clusters near major consumption centres will be established. A national policy will be drafted for development of the cooperative sector.

7. Urban and Rural Development: A transit-oriented development plan will be formulated for 14 large cities with a population over 30 lakhs.

8. Three crore additional houses will be built under PM Awas Yojana in rural and urban areas.

Comparison of key parameters:

Analysis:

1. All major policy announcements are positive takeaways. They are welcome but the proof of the pudding is in eating. Implementation is key and outcomes will be the criteria to measure performance.

2. The allocation for Capex is higher by 17.1%, a commendable measure because our basic infrastructure such as roads, highways, ports and airports are creaking. They need massive upgrades.

3. The total receipts are higher by 15% whereas the total expenditure is higher by 8.5%.

4. Disinvestment means “selling family silver”: privatising PSUs. The actual revenue is about half of the budgeted goal. So, the GoI has downsized the goal to 50,000 crore Rupees. My personal opinion is that tougher goals should be set for the department of disinvestment. The GoI should not own businesses such as luxury tourist buses, hotels, general insurance, asset management (mutual funds), shipping, logistics (road freight, warehouses and related). The list is not exhaustive.

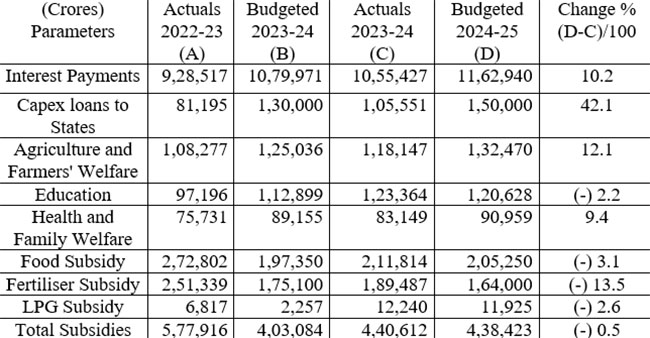

Allocation to major expenditure heads:

Analysis:

1. Interest burden is higher; it’s unlikely to be eased in the near future.

2. The whopping increase in allocation for loans to states for capital expenditure is mainly due to the special package to Andhra. This is required for the survival of NDA coalition government.

3. The decrease on subsidies is in the right direction. There have to be identification of leakages to exclude middle class beneficiaries like richer farmers, the better-offs in the unorganised sector, professionals like lawyers, CAs etc., and traders in mofussil neighbourhoods. These subsidies should reach those who are poor, destitute and worthy of government support.

4. The GoI must close down ministries and departments for agriculture, education, health and family welfare, and a few more in the concurrent list. The funds allocated for these activities must be distributed to states using a fair model of devolution.

Discussion on ever increasing Debt:

1. Refer to the bar graph above. After the NDA under Vajpayee demitted office in May 2004, Manmohan Singh-led UPA rule of ten years saw the public debt of GoI decreased from 67.13% to 51.42% (as % GDP). However, the Modi-led NDA rule of ten years after UPA demitted office in May 2014 saw the public debt rise to 58.12% (as % GDP).

2. The GoI had capped the borrowing limit of states to 3.5% (as % of GSDP) since FY 2022-23, which includes conditional 0.5% for power sector reforms. The GSDP at 8.6 lakh crore and per capita GSDP at 54, 000 Rupees of Bihar makes it the poorest among our states and union territories. Hence, its borrowing capacity is limited. In view of this, Bihar should have been given a special package. This did not happen despite the support of JDU with 12 seats and LLP with 5 seats as crucial as kingmakers.

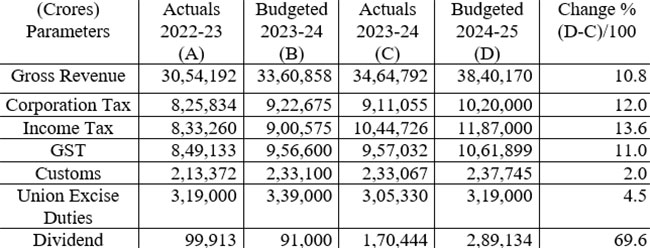

Budgeted total receipts for FY 2024-25:

Part 2: Discussion on who bears the Tax Burden:

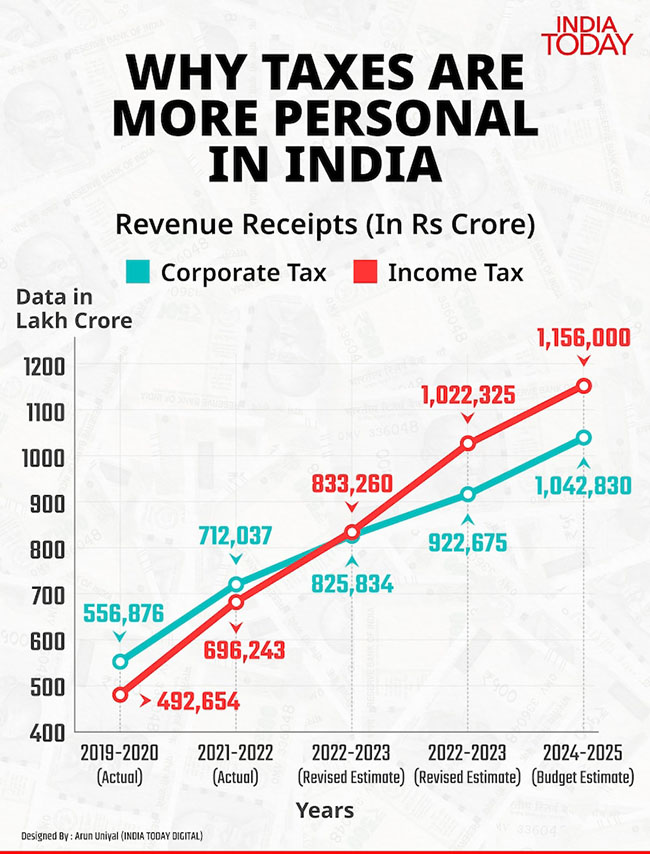

1. The maximum corporate tax rate was cut in 2019 from 30% to 25%. Intent was to spur Capex spend by private sector and incentivise job creation. This cost annual revenue loss of Rs 1.44 lakh crore upwards. This budget estimates corporate tax at 26.56% of total revenue.

2. The Economic Survey 2024 showed that between FY20 to FY23, corporate profits have quadrupled. The BSE SENSEX has doubled from 39,000 to 80,000. The net profits and market cap boom show that the corporate sector is performing very well, but paying less taxes.

3. The desired outcome of more private sector jobs has not achieved.

4. The middle class bears the brunt. Maximum personal income tax rate continues to be 30% for annual taxable income of 15 lakhs and above. The share of personal income tax in total receipts is 30.91%. Unjustly, individuals are paying higher taxes than the corporates.

5. GST contributes 27.65% to the total revenue. This is collected at point of sales and transactions level. The businesses get 33% refund as input tax credit of GST deposited. The individuals get nothing. The businesses pass on their GST burden to customers and in effect do not incur any tax.

6. The Union Excise duties contribute 8.31% to the total revenue. The businesses collect these levies but pass them on to the ultimate customers within the country. This means the entire burden of excise levies falls on the average citizens.

7. Together, the individual citizen bears 66.87% of the GoI taxes at highest levels of income and aspirational consumption.

8. While individuals are taxed on income and consumption, corporates are taxed on profits only after deducting expenses from income. There is no parity.

Discussion on taxation policy:

1. The last time individual taxpayers received tax incentives was in FY 2012-13 budget. Eleven years ago the much-maligned UPA-2 which was a tottering coalition government rationalized personal income taxes with slab rates applicable in “old regime”.

2. During the 10-years rule of Modi, he has enjoyed absolute majority in the Lok Sabha. All predecessor governments since 1988 were coalition governments; yet, they implemented pro-people taxation policies. Thirteen budgets later too, the Modi-led NDA coalition government has chosen to ignore the taxpaying middle class once again.

3. The food inflation over the decade has been in double digits. Prices of every basic food staple has more than doubled since FY 2012-13, most of it under Modi’s watch. More on this in another chapter.

4. The middle class which is around 31% of our population, pays both direct and indirect taxes. Yet, it has to rely on private schools and hospitals. The quality of public schools is so dismal, even the poor choose to borrow money for sending their children to private schools.

5. The condition of governments’ hospitals is hopeless. There is no national health-care system at all. Ayushman Bharat is only much hyped talk!

6. There are the highway tolls. Even those using public transport bear their share of these tolls. If the middle classes are sick of the poor urban public transportation system and opt to own private vehicles, their Opex (operating costs) is a huge burden. They cough up for huge petrol, diesel or CNG bills because the prices of petro-fuels are still administered with hefty central and state excise, VAT and other levies.

7. The middle classes who pay the most taxes have no social security and pension support. To each his own; God for everyone!

Part 3: What’s in it for the poor?

Almost two-third of our population belongs to the poor classes. Most of them are engaged in either farming on their own small plots of land, or are agriculture labourers working on others’ farms. Farming is a seasonal activity so these labourers are idle for half the time. In the state of Kerala, coastal districts of Karnataka, Maharashtra, Gujarat and Goa, the daily wage labour is scarce and command about Rupees 750-800 per an 8-hour day. Elsewhere, the wages are 350-400 Rupees for 10-11 hour day. The government has fixed MGNREGA wages at 356 Rupees per day, for a guaranteed work of 100 days in a year.

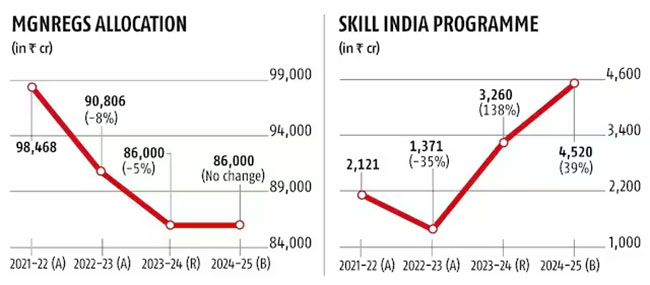

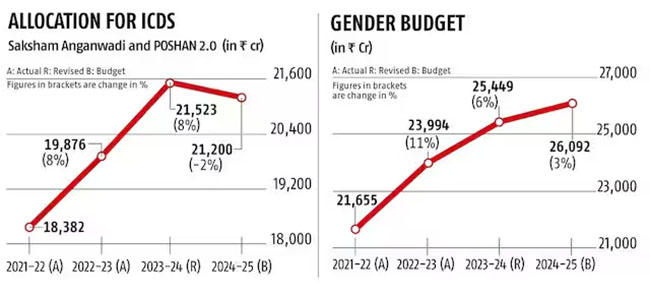

These people desperately need the government to create conditions for year round work at a reasonable minimum daily wage. These people need neighbourhood schools which offer free basic education up to Class X. These people need access to neighbourhood health-care centres akin to Mohalla Clinics of Delhi-NCT and Punjab. These people need MGNREGA until government creates alternate opportunities of full-time employment. These people were local artisans once upon a time in self-sufficient villages. They lost their livelihoods due to mechanization, industrialization and corporatization. These people require re-skilling or revival of village crafts.

For all these social sector initiatives, the budget has once again allocated chillar (loose change). Further it is not known what percentage of the allocation is for administration of these government departments and what share is received by the beneficiaries.

Yet, the GoI has made half-hearted efforts to acknowledge that poorest of the poor exist.

| Comments on this Article | |

| Ronald Sabi, Moodubelle | Thu, August-1-2024, 11:09 |

| True, for sveral areas budget has once again allocated chillar (peanut) support. Middle class is most affected. Making money in real estate and shares attracts more tax. They have shown alternatives. Very complicated to understand exmptions or applications. Even hardcore supporters of the regime has started feeling the heat. Majority tax payers are annoyed to large extent that they do not get benefits be it vehicles, roads, street lights and health support. I would attribute all the frustration to high level corruption and lack of dedication by the operational machinery. Thanks Philip for detailed focus on the subject. | |

| Nandanan, Thrissur | Wed, July-31-2024, 4:29 |

| Thank you Sir, for including my few lines with your article in preface. “Taxes and more taxes” that is the message I am getting in every budgets. Whenever Central Government gives some tax cut, the State Government budget will take it into their treasury. Common man never gets it. New schemes are announced in every budget. Is there any mechanism for common man to know the implementation of such announced schemes, apart from the “right to know” window.? For example, last year budget announced free installation of 1 cr solar power units across the country. FM can, before the new budget presentation, give a brief on the actuals of last year’s budget on public interest., at least on those schemes. Whatever may be happening in the country, the stock market is rocketing. It gives an impression that our economy is doing good. I would suggest to the Author that the chapters may be made shorter. People do not devote their time on reading these days. Shorter the write up, higher the number of people who will like to read the material. | |

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print