Electricity Supply: Which is better, Private or State?

By Philip Mudartha

Bellevision Media Network

01 Aug 2022:

Preface:

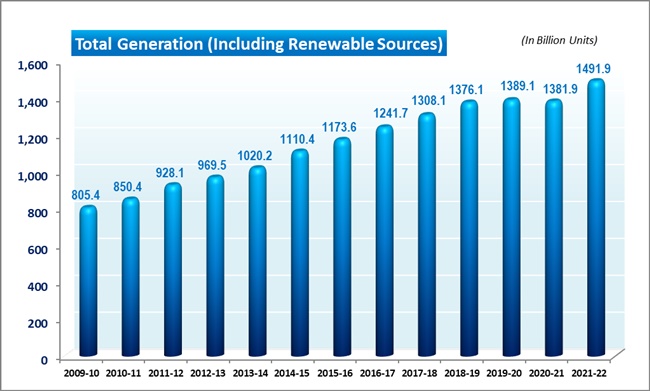

India ranks third among all the electricity-producing countries and second in consuming electricity globally. There are three segments in Electricity Supply Chain: 1) Generation 2) Transmission and 3) Distribution.

Generation Segment insights:

As of June 2022, India’s installed power capacity is 403.76GW. In India, electricity generation primarily depends on thermal sources, coal, lignite, gas, and diesel. Thermal power generation accounts for 58.5% of the total installed power generation capacity. Of which, coal accounts for 50.6%, gas 6.2%, lignite 1.6% and diesel 0.1%.

India has several renewable energy sources such as hydro, wind, and solar which are non-fossil fuel based. Besides, there is a small nuclear power generation capacity of 6.78 GW. Total non-fossil fuel power plants installed capacity is 41.5%, of which solar is 14.3%, wind 10.1%, hydro 11.6%, bio-mass 2.5%, nuclear 1.7%, small hydro power 1.2%, and waste to energy 0.1%.

Power generation was delicensed in 1991 following economic liberalization. As of June 2022, private Generation Companies (Gencos) account for 49.5% of total installed generation capacity. The central government owned CPSUs have 24.5% and all State governments owned SPSUs account for 26.0%.

NTPC is a major CPSU Genco with total installed capacity of 69,134.20MW with 23 coal based, 7 gas based, 1 Hydro, 1 Wind, 18 Solar and 1 Small hydro plant.

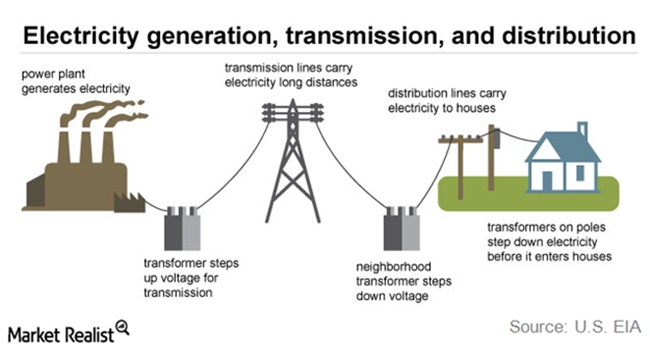

The graph attached below actual total generation of power for the past 13 years. The data is sourced from the Government of India, Ministry of Power website.

Transmission Segment insights:

An electric power transmission system transmits power from generating Gencos to load centers where the power is used. Generally, Gencos are not located closer to where the majority of the power is consumed. Electric power transmission is usually achieved over long distances to the distribution grid located in populated areas. Electric power transmission involves bulk movement of electrical energy from a Genco to an electrical substation. The interconnected lines in the system carry the electrical power and are known as transmission networks.

It isn’t cost-efficient to store electricity, which must be transferred as soon as it’s generated. Any fluctuation in demand must be immediately matched with the power supply. This calls for smart a real-time demand-supply management of the National Grid.

The total installed substation capacity for transmission is 11,26,287 MVA. The transmission lines are spread over 4,60,358 circuit kilometers.

Power Grid Corporation of India is a major transmission company (Tranco) with 4,85,777MVA substation capacity (43% of national grid) and 1,72,662ckm of transmission lines (37.5% of national grid). Besides Power Grid, which is a listed and traded CPSU, there are several SPSUs and private sector Trancos such as Tata Power, India Power, CESE, Torrent Power and Adani Transmission.

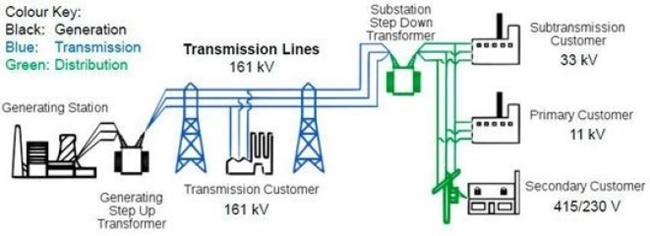

Distribution Segment insights:

Distribution is the most important link in the entire power sector value chain. As the only interface between utilities and consumers, it is the cash register for the entire sector. Under the Indian Constitution, power is a concurrent subject and the responsibility for distribution and supply of power to rural and urban consumers rests with the states. Government of India provides assistance to states through various Central Sector or centrally sponsored schemes for improving the distribution sector. The final segment of distribution is shown in green color in the graphic attached below.

As on June 2022, annually 1380BU of electric power was distributed by all discoms, both states-owned and their franchisee private discoms.

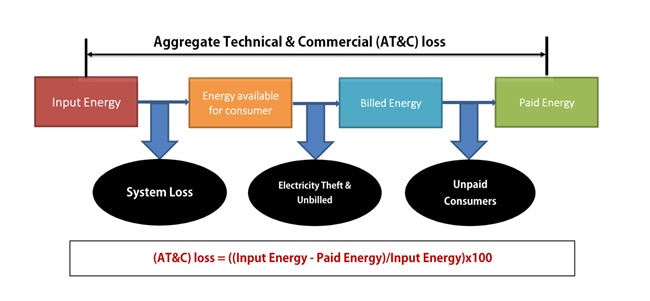

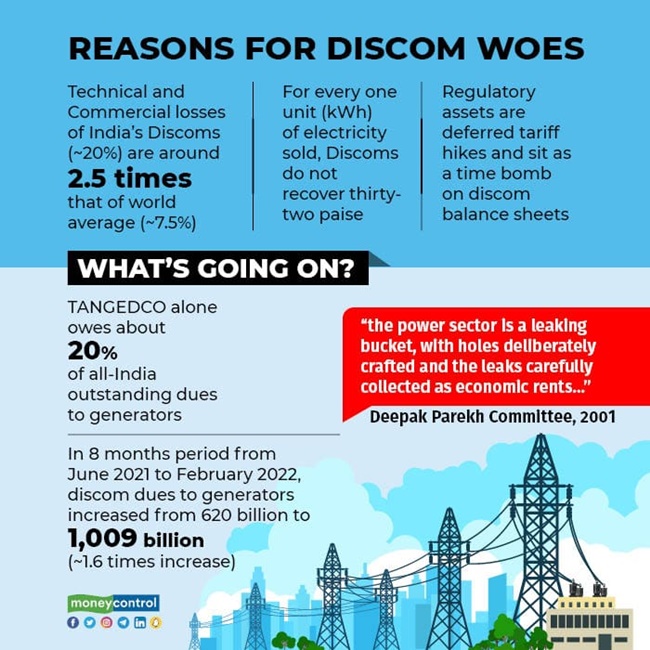

One of the major problems facing discoms is the technical and commercial losses which are 2.5 times that of the world average. (Source: FY21 Economic Survey). In layman terms, this means that not all of what is generated is supplied, not all of what is supplied is metered, not all of what is metered is billed, and not all of what is billed is collected as revenue from customers. Between generation and bill collection, about 20% of units go unaccounted for and therefore cause a revenue loss to discoms. The below chart summarizes the aggregate & Commercial (AT&C) loss in the power supply chain.

The AT&C loss in the USA is 6%, in China 5% and the global average is 7.5%. If the AT&T losses are brought down to global average, all households in the country can be supplied uninterrupted electric power and at lower tariffs than are imposed now.

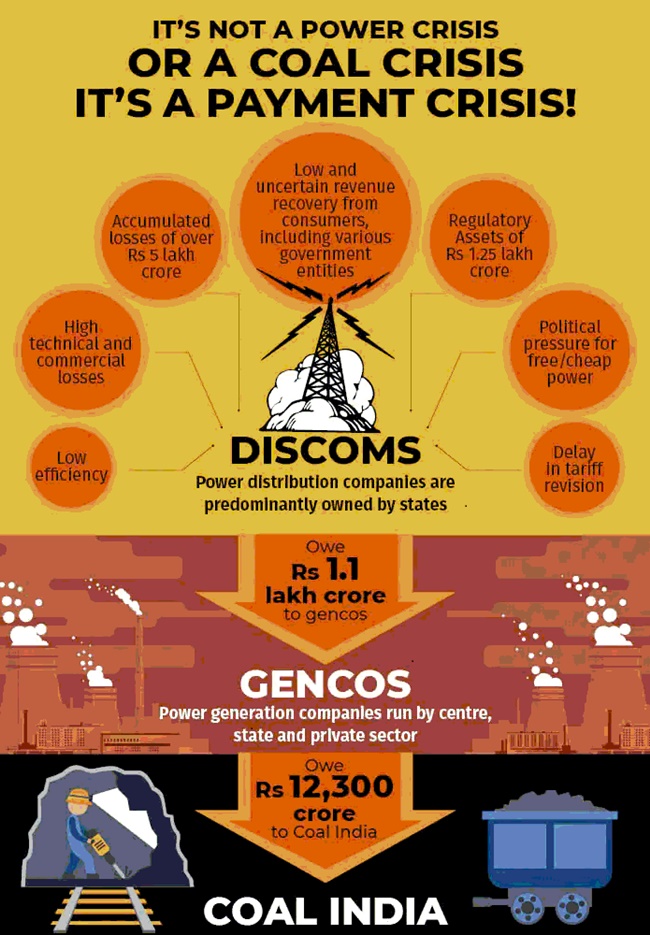

As of June 2022, coal-based Gencos are hit with triple whammy: 1) Coal shortage, 2) Price of Imported Coal, and 3) Discoms dues.

Study both the graphs which are self-explanatory. The discoms are in debt and the Gencos have no money to pay Coal India or international importers to procure coal for their inventories. The international coal price has settled around $410/MT (tripled due to the Ukraine War).

After beating round the bush with the generation, transmission, distribution and consumption of electric power in India, I return to the main question which is posed as the title of this essay: Electricity Supply: Which is better, Private or State?

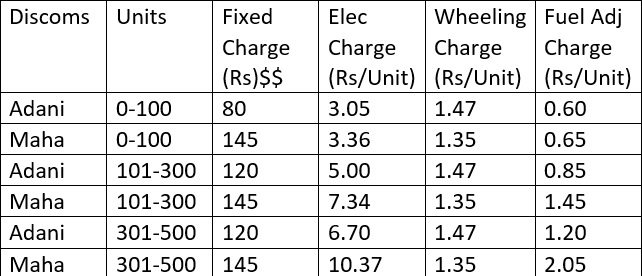

Tariffs by Adani Electricity and Mahavitaran in Mumbai:

The Adani Electricity is the discom in Mumbai Suburbs while state-owed Mahavitaran (Maharashtra State Electricity Distribution Company) is the discom for Thane, Navi Mumbai and beyond in Maharashtra. Their tariff card is given below:

$$: Fixed Charge for residential 3phase >10Kw connection, Adani rate Rs 290 for all slabs and Mahavitaran Rs 360 for all slabs.

Additionally, the General Electricity Duty of 0.16% on total monthly bill is charged for both cases. Also, Maharashtra State Tax of 26.04 paise per Unit consumption is charged in the case of Adani Electricity.

I used the tariff rates provided in the table above, the general electricity duty, fixed charge for 3 phases >10Kw residential connection, and state tax (only in the case of Adani Electricity), I calculated the monthly bill for 500 units consumed. The total bill by Adani will be Rs 4932.60 while that by Mahavitaran will be Rs 6586.48 only.

A Mahavitaran customer pays 33.5% more than his Adani counterpart for the same monthly consumption of 500 units. It is a no-brainer which is better? Private discom or state discom.

In the interest of paying consumers, an option should be available to switch from the state discom to a private discom. There sure will be a disruption similar to what has happened in the telecom sector, where subscribers have ditched MTNL and BSNL in favor of Jio or Airtel.

If Adani Electricity can make profits despite offering lower tariffs to its consumers, why the state-owned discoms make losses and owe such debt to Gencos? That is an entirely different story for another time.

There are some state governments which have given free electricity to a section of households. In some states, electricity supply to agriculture pump sets is either free or subsidized. What are the implications of such populist policies? Those are issues to be debated in another story.

Write Comment |

Write Comment |  E-Mail To a Friend |

E-Mail To a Friend |

Facebook |

Facebook |

Twitter |

Twitter |

Print

Print | Comments on this Article | |

| Clarence, Mangalore/Doha | Sat, August-6-2022, 9:45 |

| Very informative interesting article on power generation and consumption. It is true that many places the power supply is not metered and billed. It is a large number that 20% of the total units get un accounted. Indian administration should seriously think on this issue Thanks Philip once again for nice article | |