Mumbai: Model Cooperative Bank Ltd. holds 107th AGM

By Rons Bantwal

Bellevision Media Network

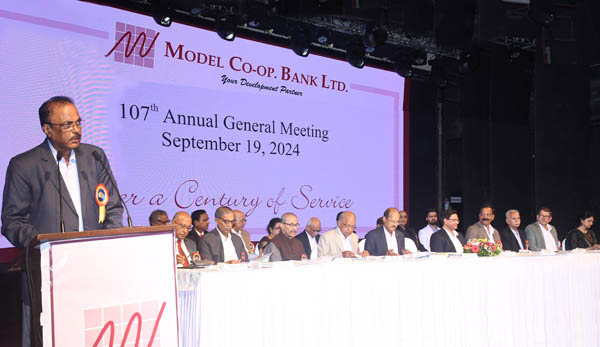

Mumbai, Sept: 19: The 107th Annual General Meeting of Model Co-operative Bank Ltd. was held on Thursday 19th September 2024 at St. Andrew’s Auditorium, St. Dominic Road, Bandra (West), Mumbai. The meeting commenced with a short prayer service led by Rev. Fr. Kinalia D’Souza, Assistant Parish Priest, St. Joseph’s Church, Juhu.

The Chairman Mr. Albert W. D’Souza presided over the meeting and extended a warm welcome to the shareholders. He thanked them for attending the Annual General Meeting and reposing their trust in the Bank.

Vice Chairman Maxim Pinto, Directors Vincent Mathias, Paul Nazareth, Abraham C. Lobo, Sanjay Shinde, Thomas D. Lobo, Lawrence D’Souza, Adv. Pius Vas, Gerald Cardoza, Ancy D’Souza, Hilary L. Mendonca, Adv. Fiona M. Nazareth, Asha D’Souza, Ronald H. Mendonca, Board of Management Members CA Elroy Rodrigues, Mr. Jude P. Lobo and Adv. Sanna A. Lobo were seated on the dais.

The Chairman in his address to the shareholders announced a change in the leadership of the Board of Directors, stating that Mr. William J. Sequeira has stepped down as Vice Chairman, but continues as a Director. Mr. Maxim I. Pinto has been elected as the new Vice Chairman, effective December 20, 2023.

The Chairman informed the Shareholders that in the Financial Year 2023-24, our Institution has shown resilience and adaptability, despite the challenging economic environment. The Bank has achieved deposits of Rs.1216.04 crs, a growth of Rs.63.58 crs. The advances of the Bank have decreased slightly by Rs.11.63 crores, from Rs.617.00 crs. to Rs.605.37 crs. The Net NPA is Nil as compared to 0.94% in the previous financial year. The Net Profit (after tax) stood at Rs.10.22 crs. The Bank continues to meet all the parameters for a Financially Sound and Well Managed Bank.

The Bank provides most of the digital services such as Mobile Banking, Internet Statement View Facility, UPI Payment Interface, Tie-Up for Card Swipe Machines, Contactless Tap-ATM Debit Cards, RuPay ATM cum Debit cards and Platinum RuPay Debit Cards. 40% of the Banks active customers are utlising its range of digital services. The Bank is poised for further growth as it continues to expand its digital offerings. The Bank also has Authorized Dealer Category II license for Full Fledged Money Changing Operations for Foreign Exchange as well as NRE accounts for our NRIs.

The Chairman presented the Audited Statements of Accounts including the Balance Sheet and Profit and Loss Account for the year ended March 31, 2024. The Members raised queries and the Chairman and General Manager & C.E.O Mr. Osden A. Fonseca provided clarifications to the queries to the satisfaction of the Members present.

Shareholders Cyril Fernandez, Arthur D’Souza, John Lobo, Henry George D’Souza, Joseph Mathias, Mariam Rodrigues, Roshan Saldanha, Rita Desa, Henry Lobo, Desman J. DSilva, Irene Noronha, Nelson David Corda gave their suggestions during the Annual General Meeting.

Additional General Manager Mr. Zenon D’Cruz, Assistant General Managers Mr. Jude D’Silva, Mr. Ratnakar Shetty, Mr. Naresh Thakur, Mr. Alwyn D’Sa and Chief Compliance Officer Mr. Digambar Prabhutendolkar were also present.

The Annual General Meeting was preceded by Training programme for the shareholders conducted by Mr. Ravikiran Mankikar, Principal Faculty of ‘The Maharashtra Urban Co-op. Banks’ Federation Ltd. and also Founder & Chairman of M/s. RKM Consultants. The training covered topics in Rights & Responsibilities of Shareholders, KYC and Cyber Security.

Chairman Mr. Albert W. D’Souza Welcome the Gathering. Vice Chairman Maxim Pinto addressed the gathering. Ms. Beata Carvalho, Senior Manager and Ms. Candy Fernandes, Manager compered the programme. Director Mr. Thomas Lobo proposed the vote of thanks.