FY 2024-25 Union Budget is a political tool

By Philip Mudartha

Bellevision Media Network

14 Feb 2025:

The union budget delivers Delhi NCT to Modi:

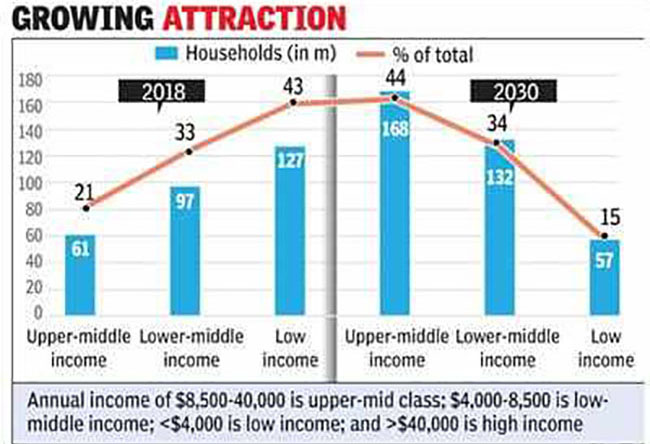

The budget was focused on winning Delhi NCT assembly elections which were held on 5th February 2025, only four days later. The budget announced massive tax relief to the middle classes. The middle classes constitute about half of the Delhi voters. In addition to the central government employees, they form the creamy layer and earn more than one lakh rupees per month. As beneficiaries of Modi bonanza, they were expected to vote out AAP from power and vote BJP.

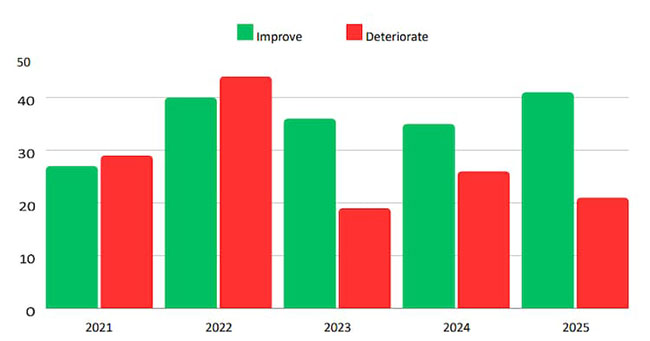

Scores of surveys done by C Voter since the 2024 LS election had indicated that the middle-class voters were dissatisfied with Modi government. Their despair disappeared when FM announced a massive tax bonanza for them. Prior to the budget speech, about 30% of respondents in the C Voter Tracker survey had said that they expected their quality of life to improve in the next year, while more than 37% expected it to deteriorate. The budget, however, had a near-magical impact on middle-class perceptions. According to the tracker survey of 2nd February, 40% expected their quality of life to improve while 24% expected it to deteriorate in the next year.

There is no doubt that the middle classes were won over by BJP using the tax relief announced in the union budget.

How would the middle classes spend the tax bonanza?

The government hopes that the tax savings will spur household consumption. Companies in the FMCG sector should logically benefit. But, such hope is not borne out so far. A fortnight after the budget was unveiled, stocks of FMCG sector have not seen any gains. For example, the stock price of Hindustan Unilever (HUL) had closed at Rupees 2468.80 on the day before the budget; it closed at Rupees 2318.35 on 14th February 2025, suffering a 5.7% drop. HUL is the market leader in the sector.

We have to wait and watch: the tax savings will be in the hands of the mostly young upwardly mobile professionals. Their FMCG consumption may have peaked even before the budget. They may now opt to reduce their existing debt. They may travel abroad. They may spend lavishly on destination weddings. They may even opt to own a house instead of living in rental premises. Their behavior may be unpredictable.

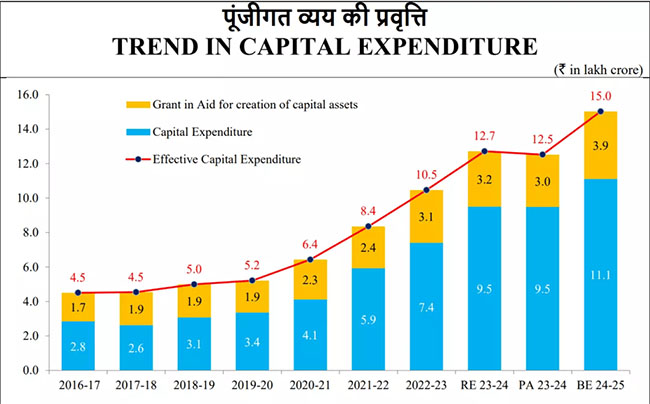

The Government spends on Infrastructure:

This year, the government has budgeted 11.21 lakh crore rupees towards Capital Expenditure. It is 3.1% of GDP. It has learnt a lesson from the previous year. The private sector cannot be depended upon to invest in basic infrastructure projects. The construction companies depend mostly on government contracts.

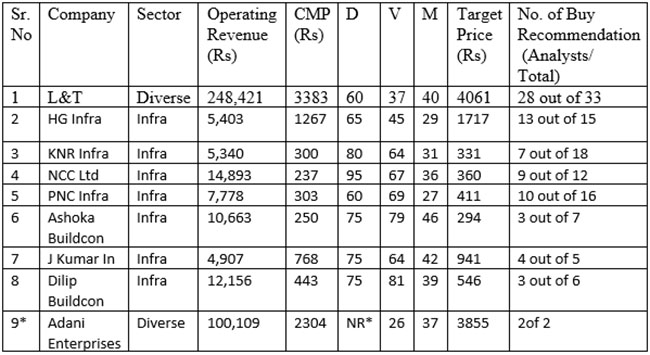

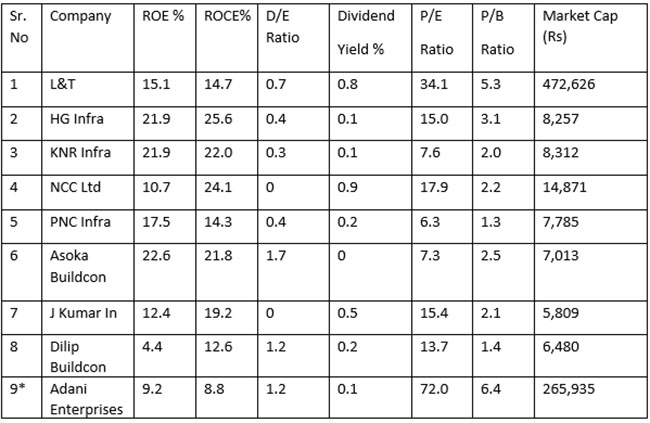

In view of this, I have tabulated the performance of 9 companies in the sector.

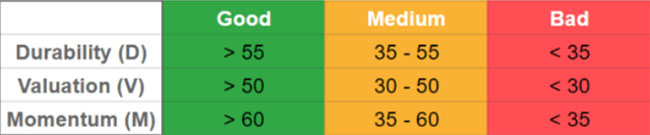

1. The D score denotes the quality, financial strength, and many other criteria. A score above 55 is good.

2. The V score denotes the valuation. If the score is below 50, the stock is expensive. The higher the score, more affordable is the stock.

3. The M score denotes momentum or the market demand for the stock. A score below 60 means the investors show lower interest in buying the stock.

4. All other ratios listed in the table are self-explanatory. Please be advised that the decision to invest depends on your investment goals.

5. In my opinion, Adani Enterprises is a Risky and Speculative Investment. All others listed above are good but further analysis is recommended before making an investment decision.

6. Two Graham rules of investing is that the P/E should be less than 25 and P/B should be less than 5. L&T and Adani Enterprises are not value investing per Graham.