A perspective on Union Budget FY 2024-25

By Philip Mudartha

Bellevision Media Network

24 Jul 2024:

On 23rd July 2024, the Union of India Budget day, Nirmala Sitharaman reminded us why she is on Forbes’ World’s Most Powerful Women list: She is ranked 32, and shares the list with Taylor Swift and Melinda Gates. During the 86 minutes of her Budget speech, investors, businessmen and taxpayers tuned in from around the country, to see what would happen to their bank balances.

Tobacco, cigarettes, gutka, Indian-made foreign liquor and similar “sin consumables” are villains for any FM. This time, our FM found a new villains: the investors who earn their bread and butter in the securities market. Her particular target was Futures & Options (F&O) trading on stock markets. She doubled the Securities Transaction Tax (STT) to .02% from 0.01%. The frenzied traders raced to square-off their positions in panic. There was mayhem for about an hour: See the graph of Nifty.

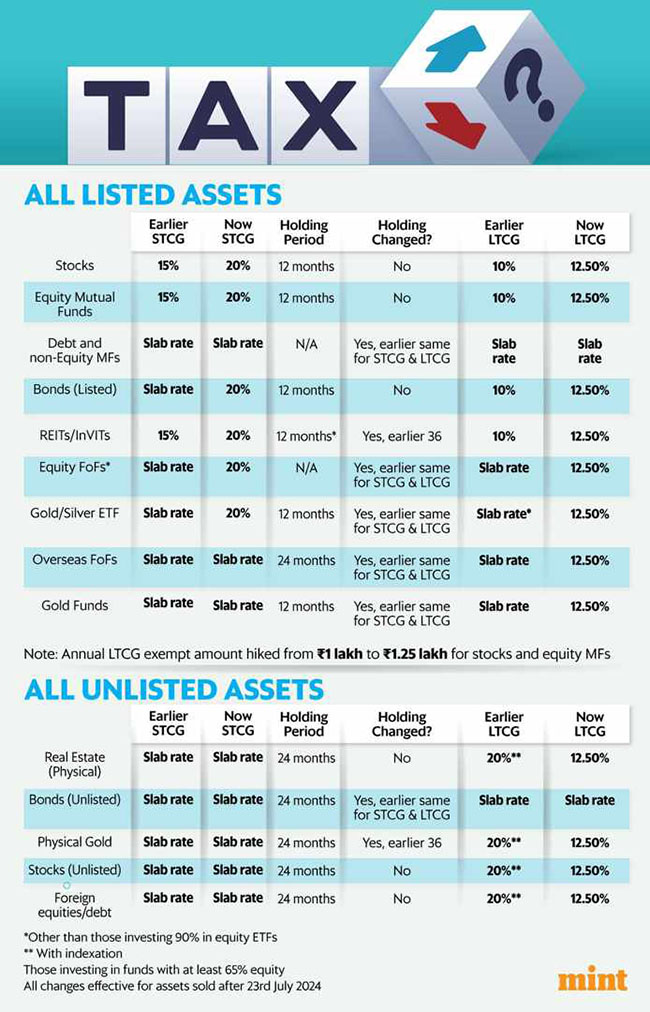

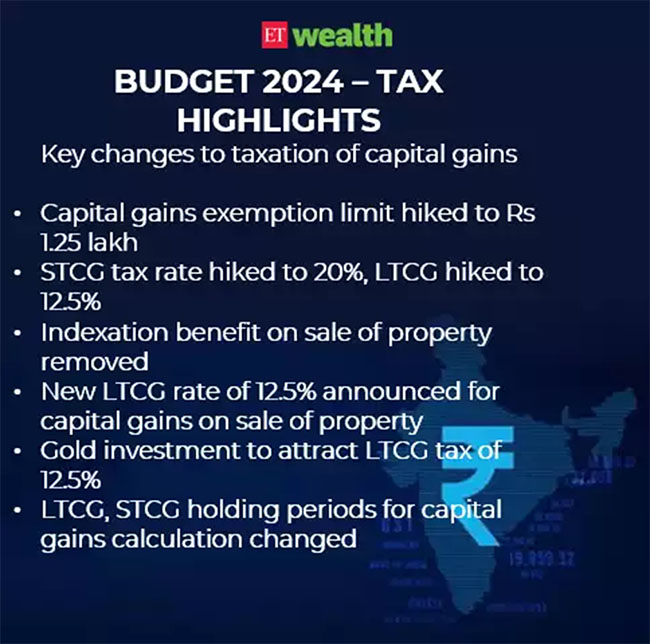

Besides the F&O tax, Sitharaman announced an increase in the short-term capital gains tax (STCG) from 15% to 20%, and increased the long term capital gains tax (LTCG) to 12.5% from 10% for all listed financial assets. She also introduced taxes on buybacks, and removed indexation benefits from long term capital gains for land and gold.

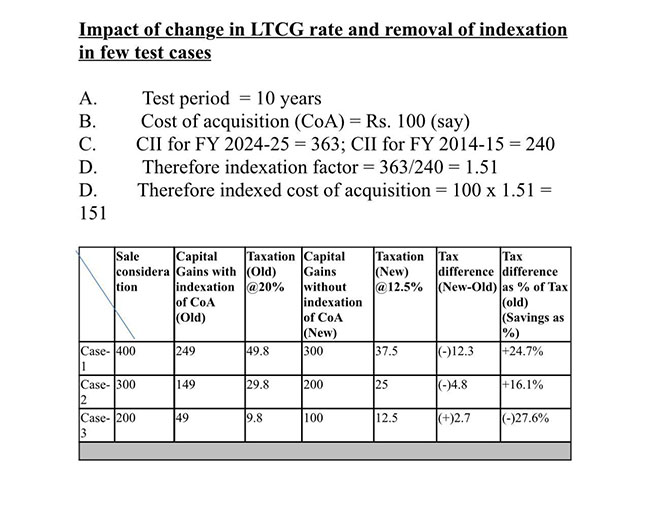

What is indexation benefits and how does it decrease the capital gains from physical non-financial assets like immoveable property (land & real estate), gold and precious metals. I will explain it a bit later.

No indexation at all has massive implications for property. People who have held for 15 years and seen their prices double, would otherwise have not paid any capital gains tax due to indexation. From 23rd July 2024, they will pay 12.5%.

However, the Revenue Secretary (RS) has a different perspective about the change in the new LTCG taxation. It is obvious the government believes that these assets have tripled or even quadrupled in ten years! See the test calculation by the RS:

The RS is right about his assumptions. Take Physical Gold: ten years ago in July 2014, Gold price was Rs 28,000 max/10 gm. Today, it is Rs 74,490/10gm. If sold today after holding for ten years, the sale consideration is Rs 266 agaisnt Cost Price of Rs 100, meaning Rs 166 LTCG on which new taxation is Rs 20.75 compared to Rs 23.00 under old taxation of 20%. Trust the government officials: they are expert pick-pockets!

Recently, the governor of RBI said that there is marked shift from bank deposits to the stock market and non-financial assets like precious metals and real estate, especially by the young, urban, educated, professional upper middle class. The government seems to have taken the hint and decided to milk them. There is a sop of increasing the exemption limit from 1.00 lakh to 1.25 lakh.

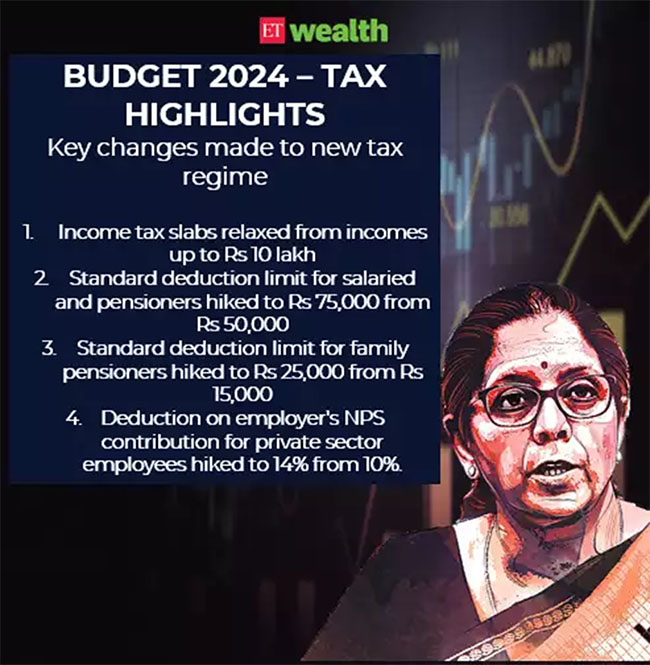

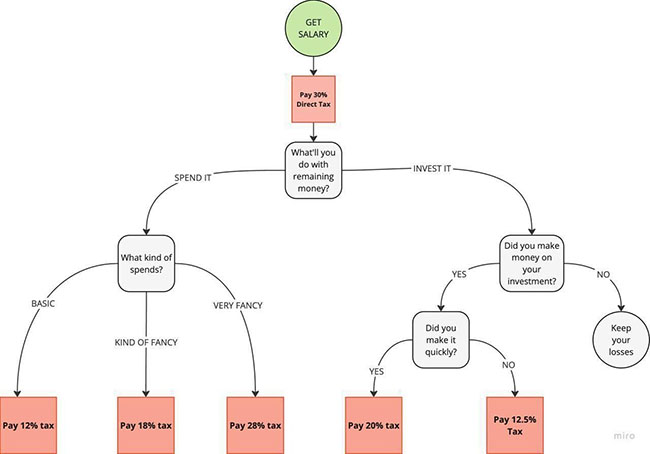

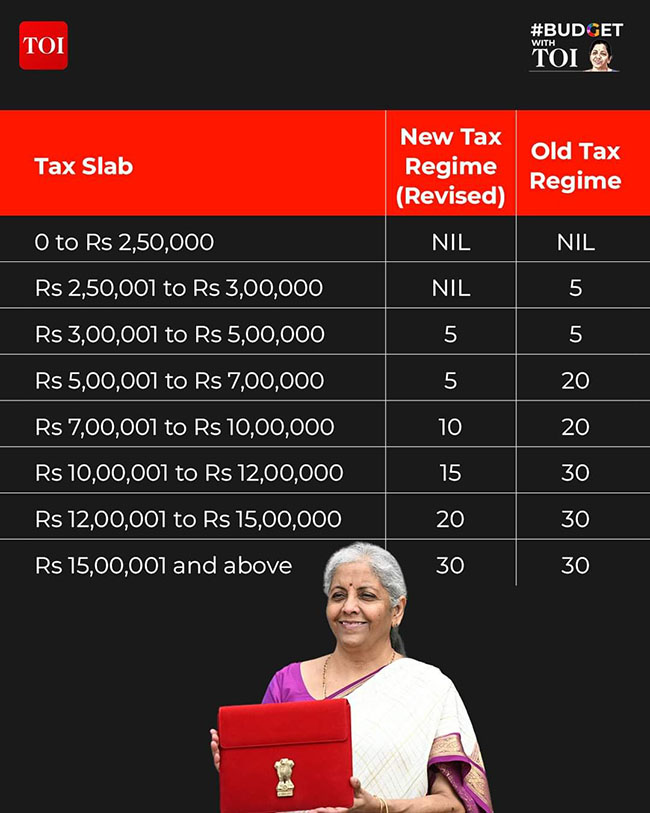

The graphics above shows what the FM took from taxpayers. The graphics below shows what the FM gave to salaried taxpayers and pensioners.

For a salaried professional earning a gross income of Rs 13.75 lakhs, the tax saving is Rs 17, 500, for others it is Rs10, 000. The government babus expect that such a pittance would be splurged on consumer goods and there will be a consumption boom. Who knows, they may be proven right!

If the taxpayers spend, the GST collections will boom. If they save and earn more money quickly, they will pay higher STCG. If the taxpayers save but don’t earn from investments, they end up keeping the losses!

Not everything is bad news for those earn, pay personal income tax, spend and pay GST, save to invest and earn profits and pay STCG or LTCG. There is some relief in the tax slab revision and changes to applicable tax rate.

Those with taxable income at or below 12 lakhs, will be paying Rs 140,000 in personal income tax which is about 9% of gross income.

After my light-hearted litany of complaints about the raw deal meted out to taxpayer like me who earn no salary, pension and any retirement benefits but depend only on passive incomes such as interest on bank deposits, dividends from listed stocks of domestic companies and capital gains from stock market investments, I have to delve in details on the positives of the budget for FY2024-25.

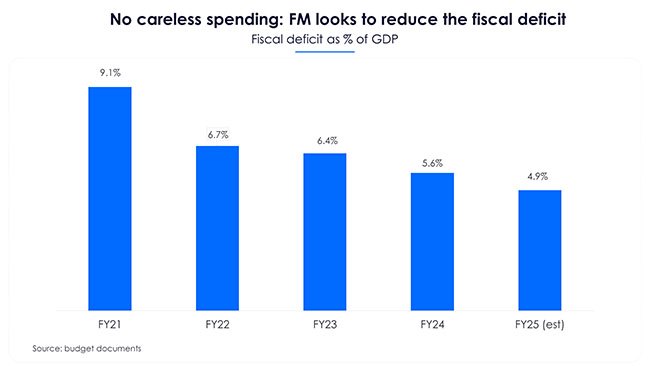

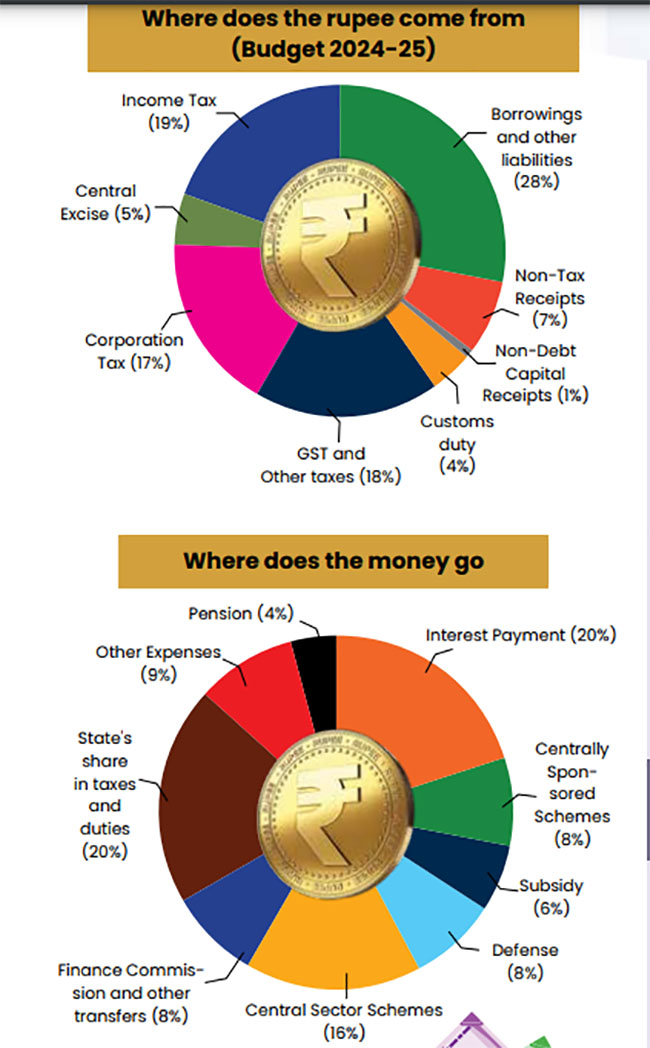

There are plenty of positives to make it a balanced budget which I will detail in the next chapter. For now, I leave you with two charts as primer!

More in next chapter.....