Union Budget FY 2024: An Overview

By Philip Mudartha

Bellevision Media Network

03 Feb 2023:

Summery:

Union Budget announced on 1 Feb 2023 was devoid of any big negatives, barring the cigarettes industry.

It was continuation of the past. Government stuck to its script of being fiscally prudent.

No major populist steps were announced. Budget tried to achieve a fine balance between growth of manufacturing, services, private consumption, long term vision and yet being prudent.

• Fiscal containment was clearly in focus, with fiscal deficit being targeted at 5.9% for FY24 from 6.4% in FY23. The budget promised to follow the glide path to reach fiscal deficit target of 3.0%. Fiscal deficit will be 4.5% By FY26.

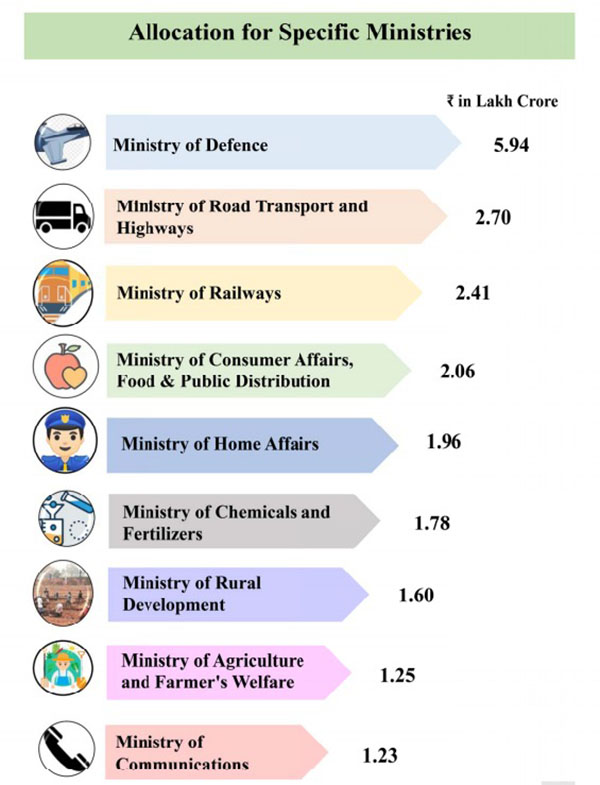

• Another focus was Capex, which the central government is increasing by 33% to Rs 10 lakh crores. The focus is on infrastructure, with higher focus on Railways where Rs 2-4 lakh crores is allocated.

• Also, impetus was towards climate change, renewables, Micro, Small and Medium Enterprises (MSME), new startups, tourism and a lot of stress towards simplification of KYC norms.

• From financial markets standpoint, the net market borrowing at Rs 11.8 lakh crores for FY24 is broadly in line with expectations, which should allay the concerns in the bond market.

Budget at a Glance:

Discussion:

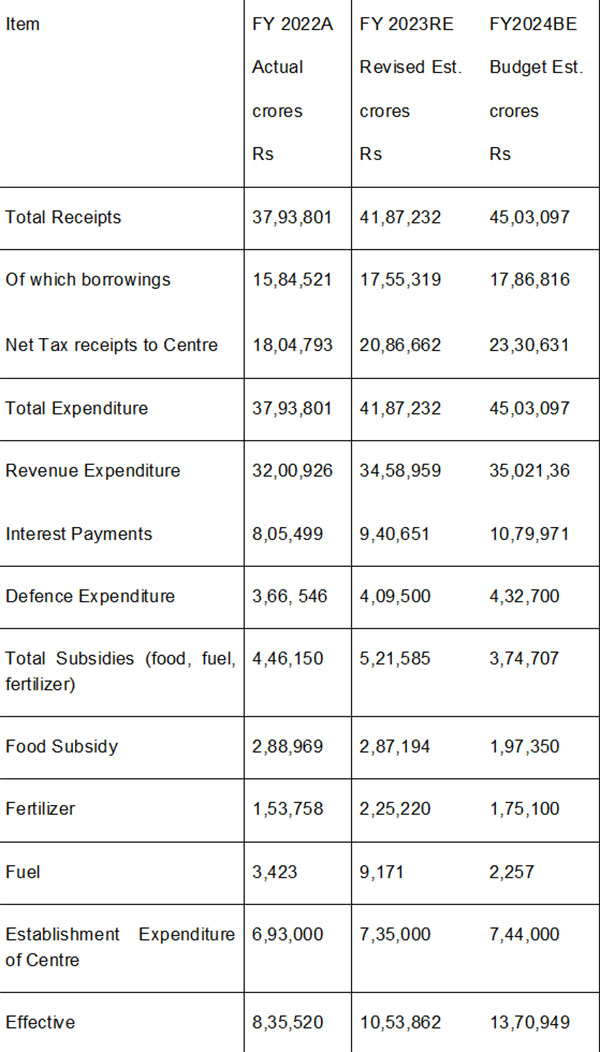

Interest payments on past borrowings stand at 46% of net tax revenues of the central government. The gross borrowings of Rs 17, 86,816 finances 39.7% of total expenditure budget.

The allocation towards subsidies (food, fertilizer and fuel) is lower by 91, 619 crores (31.7%).

The indirect tax collections (GST, Customs, and Central Excise etc.) are 83.9% of direct taxes (Corporate tax and Personal Income Tax). Indirect taxes are borne by the lower strata of the society as %age of their incomes compared to the richer strata.

The MGNREGA allocation is 40% lower compared to FY22 actuals.

PM Awas Yojana (PMAY) and PM Kisan Samman Nidhi (PMKSN) allocations are substantial. The former will benefit real estate developers and the latter the agri-business including food storage. These are likely to benefit new businesses of both Adani and Ambani.

The clout of Nitin Gadkari is visible with the 284% increase in national highways allocation. The focus on better highways is a welcome feature of the budget.

The FM Speech highlights:

FM Nirmala Sitharaman said: “We envision a prosperous and inclusive India, in which the fruits of development reach all regions and citizens, especially our youth, women, farmers, OBCs, Scheduled Castes and Scheduled Tribes.” This is the regime’s slogan of ‘sabka saath, sabka vikaas”.

At the outset she promised: “Continuing our commitment to ensure food and nutritional security, a scheme to supply free food grain to all Antyodaya and priority households for the next one year, under PM Garib Kalyan Anna Yojana (PMGKAY) with an expenditure of about Rs 2 lakh crores will be implemented from 1 Jan 2023.”

She listed the achievements since 2014:

1. Since 2014, all citizens have enjoyed a better quality of living and a life of dignity. The per capita income has more than doubled to Rs 1.97 lakh.

2. In these nine years, the Indian economy has increased in size from being 10th to 5th largest in the world.

3. Household toilets under Swacch Bharat Mission, LPG Connections under Ujjawala, Covid Vaccinations, Jan Dhan Bank Accounts, Insurance cover under PM Suraksha Bhima and PM Jeevan Jyoti Yojana, Cash transfers to farmers under Kisan Samman Nidhi are some central schemes that have resulted in inclusive development.

Economic Empowerment of Women, Skill Development of artisans and promotion of traditional handicrafts under PM Vishwakarma Kaushal Samman (PM VIKAS) scheme, Tourism and Green Growth are the four focus areas during the Amrit Kaal.

She outlined the priorities of this Budget as: inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, youth power and financial sector.

The agriculture credit target will be increased to Rs 20 lakh crores with focus on animal husbandry, dairy and fisheries. Under PM Matsya Sampada Yojana an investment of Rs 6,000 crores will further enable activities of fishermen, fish vendors, and micro & small enterprises, improve value chain efficiencies, and expand the market.

157 new nursing colleges will be established in co-location with the existing 157 medical colleges established since 2014.

To enhance basic facilities such as safe housing, clean drinking water and sanitation, improved access to education, health and nutrition, road and telecom connectivity, and sustainable livelihood opportunities for the Scheduled Tribes, an outlay of Rs 15,000 crores was made.

The direct capital investment by the Centre is raised to Rs 10 lakh crores. In addition, though Grants-in-Aid to States, the ‘Effective Capital Expenditure’ is budgeted at Rs 13.7 lakh crores, which will be 4.5% of GDP.

A capital outlay of Rs 2.40 lakh crores has been provided for the Railways. This highest ever outlay is about 9 times the outlay made in 2013-14.

One hundred critical transport infrastructure projects, for last and first mile connectivity for ports, coal and steel, fertilizer and food grains sectors have been identified. To take them on priority, investment of Rs 75,000 crores, including Rs 15,000 crores from private sources is envisaged.

50 additional airports, heliports, water aerodromes and advance landing grounds will be revived for improving regional air connectivity.

Outlay of Rs 19,700 crores to the National Green Hydrogen Mission and Rs 35,000 crores for priority capital investments towards energy transition and net zero objectives, and Battery Energy Storage Systems with capacity of 4,000 MWH are projects under Green Energy promotion.

National Calamity Contingent Duty (NCCD) on specified cigarettes was last revised three years ago. This is proposed to be revised upwards by about 16%. Stocks of ITC, Godfrey Philips and VST Industries traded lower as the budget speech was in progress.

Finally, the thresh-hold for personal income tax was raised to Rs 7 lakh to give relief to salaried middle class. Tax rate slabs were modified. The thrust was to make the new tax regime as the default one where most deductions are done away with.