A historical perspective of bank reforms

By Philip Mudartha

Bellevision Media Network

25 Jul 2023:

Preface:

During the virtual Rozgar Mela event on 24th July, PM Modi said that the previous UPA government “destroyed” the banking sector with scams. His government has restored its good financial health, with India now known for the sector’s strength. According to him, "phone banking" was one of the biggest scams of the previous government as it broke the back of the banking system. Under the phone banking scheme, thousands of crores of rupees were loaned to favourites of some powerful leaders and families. Those loans were never meant to be returned, he said.

PM Modi revels in political rhetoric at every opportunity, including when launching government projects. Before examining his claims, let me present the historical perspective of our banking industry.

Nationalization of Private Banks:

At the time of independence, there existed several private banks. In our South Kanara district, three private banks –Corporation Bank, Canara Bank and Syndicate Bank – were the leading banks. Among them, the Corporation Bank, founded by Khan Bahadur Haji Abdullah Haji Kasim Saheb Bahadur in Udupi on 12th March 1906, was the pioneer.

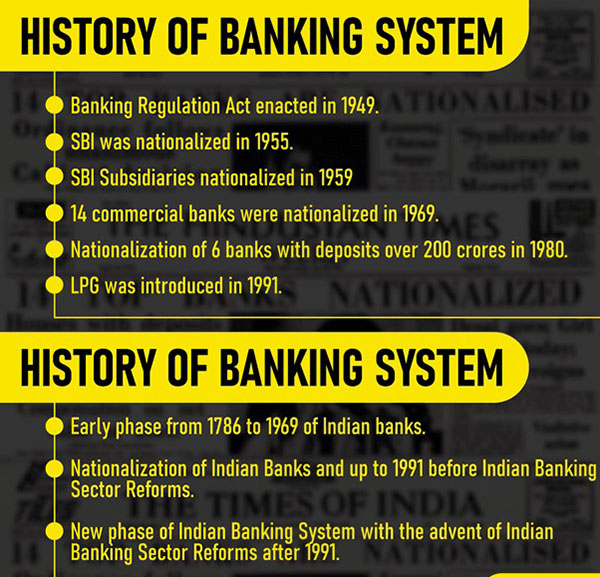

In 1934, the British Parliament passed the Reserve Bank of India (RBI) Act -1934 and founded the RBI on 1st April 1935. As the sovereign monetary agency, it issued our national currency and controlled all banks in British India in addition to its role as banker to the government. The RBI was nationalized on 1st January 1949.

One of the pre-independence era major private bank was the Imperial Bank of India founded on 27th January 1921 by renowned economist John Maynard Keynes through the merger of three presidency banks in British India. Bank of Calcutta, Bank of Bombay and Bank of Madras were these presidency banks.

The government of PM Nehru passed the State Bank of India Act-1955 in order to nationalize Imperial Bank of India and renamed as State Bank of India (SBI) on 1st July 1955. The parliament also enacted SBI (Subsidiary Banks) Act-1959 to acquire the private banks of eight major princely states and incorporate them as SBI subsidiaries.

In 2008, the process to merge the subsidiaries into SBI began and was completed on 1st April 2017. With this, SBI emerged as the largest public sector bank (PSB). The Government of India (GoI) held 56.92% shares and rest were held by foreign institutional investors, (FII) domestic institutional investors (DII) and mutual funds.

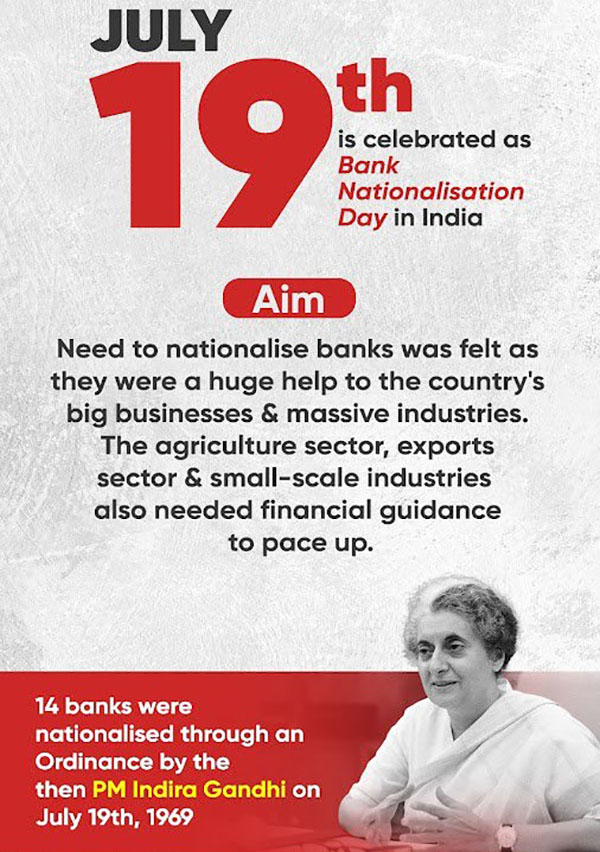

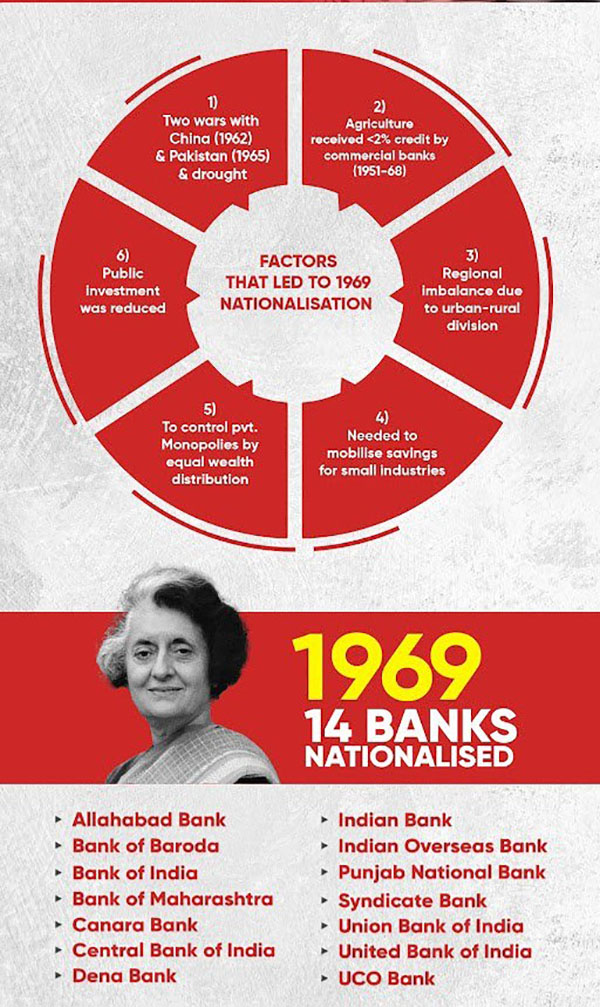

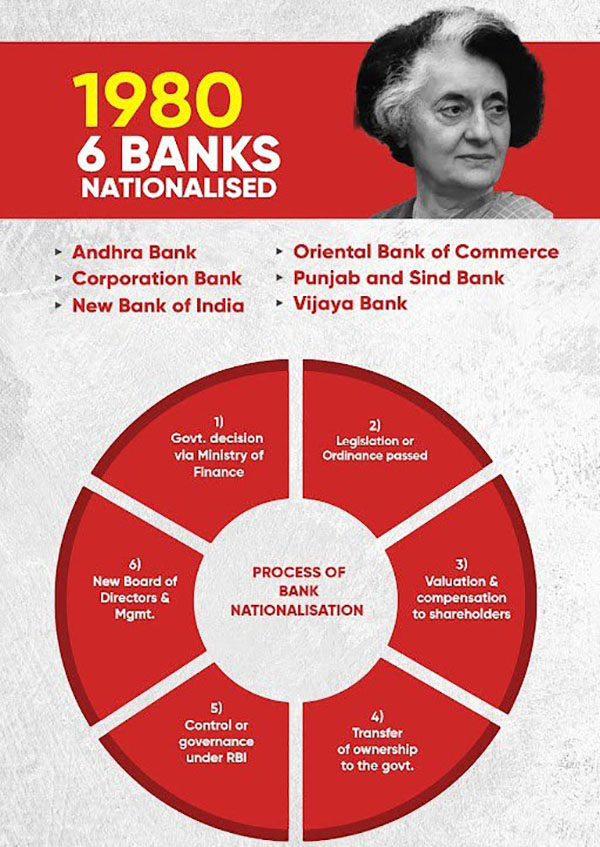

On 19th July 1969, Indira Gandhi-led Congress government nationalised 14 major commercial banks. Upon her return to power in 1980, a further six banks were nationalised. The regulation of the economy and especially the financial sector was reinforced by the GoI in the 1970s and 1980s.

The PSBs lent money in selected sectors, like agricultural business, exports and small trade companies. The Banking Commission was established on 29th January 1969, to analyse banking costs, effects of legislations and banking procedures, including non-banking financial intermediaries and indigenous banking. The following graphics summarise the aims of these socialist measures which became politically very popular.

Banking Sector Reforms since 1991:

The banking sector reforms after 1991 aimed to liberalize and modernize the banking system, to enhance efficiency, and to promote financial stability. The PV Narasimha Rao-led Congress government instituted Narasimham Committee-I in 1991 which suggested measures to strengthen the banking system, including reducing government interference, increasing the role of the RBI in supervising the banks, enhancing transparency and other reforms. Finance Minister Man Mohan Singh oversaw implementation of key recommendations within the five years of Rao government.

The successor United Front governments formed R.H. Khan Committee in 1997 and Narasimham Committee-II in 1998 to review the implemented reforms and pursue the reforms agenda. The latter committee recommended enhanced corporate governance standards, risk-based supervision by RBI and reducing the government’s stake in PSBs to less than 33%.

Twenty-five years have elapsed but GoI has not yet diluted its ownership of PSBs to less than 33%. Six years of NDA governments led by AB Vajpayee, ten years of UPA governments led by Man Mohan Singh and nine years of NDA-II governments led by Narendra Modi have not implemented the Narasimham Committee-II reforms in their entirety. The political will has eluded till date.

In 2008, UPA-I government led by Man Mohan Singh instituted Raghuram Rajan Committee to examine the financial sector reforms in India. The committee provided recommendations to strengthen the banking system, enhance financial inclusion, and promote financial stability.

In November 2008, PM MS Singh appointed Rajan as an honorary economic adviser. On 10 August 2012, Rajan was appointed as chief economic adviser to the Ministry of Finance. He prepared the Economic Survey of India for the year 2012–13. In the annual survey, he urged the government to reduce spending and subsidies, and recommended the redirection of Indians from agriculture to service and skilled manufacturing sector.

In 2011, Financial Sector Legislative Reforms Commission (FSLRC) – 2011 was constituted with Rajan as chairman. The committee, in its report titled A Hundred Small Steps, recommended broad-based reforms across the financial sector, arguing that instead of focusing "on a few large, and usually politically controversial steps", India must "take a hundred small steps in the same direction".

Committee co-chairman Justice B. N. Srikrishna outlined the steps for reviewing and restructuring the legal and regulatory framework of the financial sector. It aimed to consolidate and streamline the laws governing the financial sector, including banking, insurance, securities, and pensions.

On 6th August 2013, Rajan was appointed as the Governor of the RBI for a term of 3 years. On 5th September 2013, he took charge as the 23rd governor. Under Rajan, the RBI licensed two universal banks and approved eleven payments banks to extend banking services to the nearly two-thirds of the population who were deprived of banking facilities. He also relaxed curbs on foreign banks operating in India.

Under Rajan, RBI adopted Consumer Price Index (CPI) to measure inflation. In less than two years, he tamed inflation from 9.8% in September 2013 to 3.78% in July 2015. Under him, RBI set its inflation control target of 4% plus/minus 2%.

During his tenure, Rajan enforced two-factor authentication of domestic credit card transactions to ensure the safety of customers. Under him, the forex reserves swelled by 30% to $380 billion with cascading effect of strengthening Rupee against the USD.

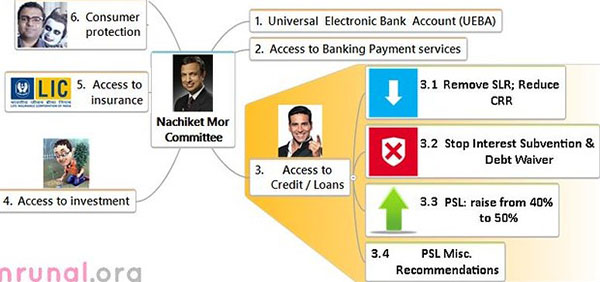

Rajan also formed the Committee on Comprehensive Financial Services for Small Businesses and Low Income Households (commonly known as the Nachiket Mor Committee) on 23rd September 2013 as soon as he took charge as RBI governor. The panel studied various aspects of financial inclusion and submitted its report on 7th January 2014.

The Nachiket committee recommended measures to increase financial inclusion, such as the establishment of payment banks, small finance banks, and the creation of a universal electronic bank account (UEBA) linked to Aadhar, which Modi renamed and popularized as PM Jan Dhan Yojana.

The payment banks would provide basic banking services, including payments and remittances, to underserved sections of society. These banks would have low entry requirements and existing banks would be allowed to form subsidiaries under this category.

Rajan also formed PJ Nayak Committee in 2014 to examine the governance of the boards of the PSBs and suggest improvements to enhance their efficiency and governance. It was tasked to suggest measures to strengthen the accountability of the bank boards to stakeholders and review the appointment process of board members including the independent directors so that suitable candidates are selected.

The recommendations of PJ Nayak Committee are as follows:

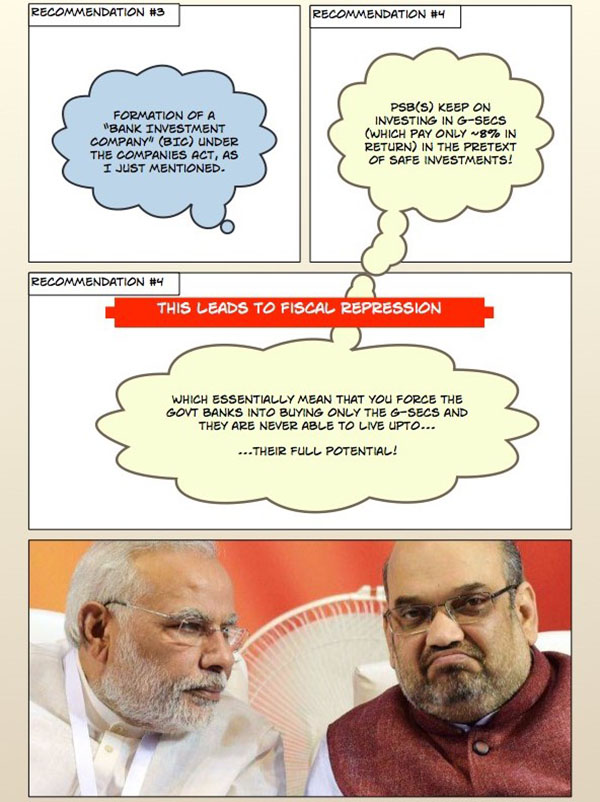

1. Repeal certain acts like the SBI Subsidiaries Act, the SBI Act and the Bank Nationalisation Acts of 1970 and 1980.

2. Form a Bank Investment Company (BIC) in the form of a core investment company or a holding company. The government should transfer its shares in the banks to the BIC.

3. All PSBs should be subsidiaries of BIC. BIC would be an independent organization free of governmental control. It would have the authority to recruit board of directors of PSBs and undertake their policy decisions.

The successor Modi-1.0 government did not implement PJ Nayak committee recommendations. Instead, it introduced the Indradhanush framework to revitalize and reform PSBs. The framework aimed to improve the efficiency, transparency, and governance of PSBs and strengthen their ability to support economic growth.

The framework aimed to address key areas of banking sector reforms, described as the seven pillars, which are:

Appointments: Enhancing the selection process of top management positions in PSBs to attract skilled professionals.

Bank Board Bureau (BBB): Setting up the BBB as an autonomous body to provide guidance and enhance governance in PSBs.

Capitalization: Injecting capital into PSBs to strengthen their balance sheets and enable them to meet Basel III capital adequacy norms.

De-stressing: Implementing measures to address the issue of non-performing assets (NPAs) and stressed assets in PSBs.

Empowerment: Granting more autonomy to bank boards and empowering them with greater decision-making authority.

Framework of Accountability: Introducing a framework to hold the management of PSBs accountable for their performance.

Governance reforms: Enhancing transparency, risk management, and governance practices in PSBs.

HR Khan Committee was formed in 2015 to examine the existing framework for monetary policy in India. The committee made recommendations on issues such as inflation targeting, monetary policy transmission, and improving the decision-making process of the RBI’s Monetary Policy Committee (MPC).

4R Framework (Recognition, Recapitalization, Resolution, and Reforms) was introduced in 2017 as part of the government’s strategy to address the issue of mounting bad loans in the banking system.

The framework focused on four key elements:

Recognition: Prompt identification and classification of stressed assets as NPAs to accurately assess the extent of the problem.

Recapitalization: Injecting capital into banks to improve their financial health and enhance their lending capacity.

Resolution: Establishing mechanisms for the timely resolution of stressed assets through processes like the Insolvency and Bankruptcy Code (IBC) and other resolution frameworks.

Reforms: Undertaking structural reforms to improve the governance, risk management, and operational efficiency of banks.

Mega Merger of PSBs:

A mega consolidation plan for public sector banks became effective on 1st April 2020. GoI merged 10 state-owned lenders into 4 entities with an aim to strengthen their balance sheets and make them globally competitive. In 2019, Vijaya Bank and Dena Bank were merged into Bank of Baroda.

The exercise has reduced the number of state-owned banks to 12. They are 1) SBI (57.59%) 2) Canara Bank (62.93%), 3) Bank of Baroda (63.97%), 4) Punjab National Bank (73.15%), 5) Indian Bank (79.86%), 6) Bank of India (81.41%), 7) Union Bank of India (83.49%), 8) Bank of Maharashtra (90.90%), 9) Central Bank of India (93.08%), 10) UCO Bank (95.39%), 11) Indian Overseas Bank (96.38%) and 12) Punjab and Sind Bank (98.25%).

The figures in the brackets are the GoI shareholding. The figures show that the BJP government led by Modi has no political will to implement Narasimha Committee –II recommendations in Toto and give up its stranglehold on PSBs.

To summarize, successive governments led by the three national parties –Congress, Janata Party and BJP – reversed the Indira Gandhi’s legacy of bank nationalization. The eclipse of communism and decline of the appeal of global socialism caused popular sentiment to embrace capitalism which gave the popular mandate for bank reforms. No single party nor PM could lay sole claim to the evolving reformist path followed since 1991.

Moving forward to the present in July 2023:

PM Modi’s rhetoric of UPA government destroying our banking system requires examination in greater details. Was he playing the blame game? Was he taking all credit to the “good performance of PSBs”? How did the PSBs regain their financial health and become the sector’s strength? This debate will have to wait for the next exclusive. I will return within a week. Till then, please feel free to give your opinion on this debate in the comments section.