Billionaire Tax, Emergency, and By-polls

By Philip Mudartha

Bellevision Media Network

14 Jul 2024:

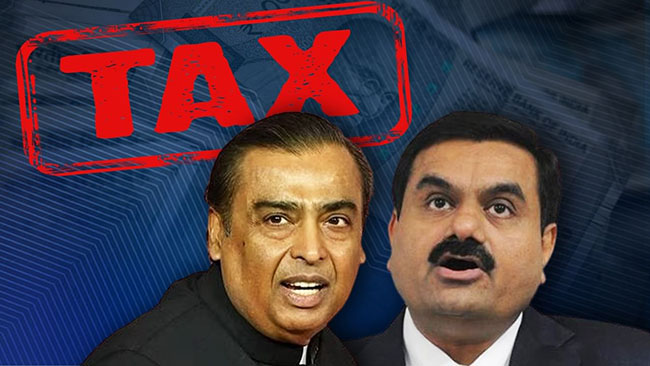

Does PM Modi has an opinion on billionaire tax?

A group of former presidents and prime ministers of the G20 countries have expressed themselves in favour of "billionaire tax". In their open letter to the current leaders of G20 group, they wrote that this initiative is a rare political opportunity.

The Indian National Congress (INC) asked what Modi’s position is on such a tax and what will India’s stand be when the matter is discussed at the G20 meet in Rio Janeiro later this month. INC said all over the world, there is a growing consensus that billionaires must pay their fair share of taxes.

"As proposed by Brazil, which now holds the annual rotational G20 Presidency, and endorsed by France, Spain, South Africa, and Germany, the world is moving towards a 2% wealth tax on these billionaires," the Communication in-Charge of INC, Jairam Ramesh, wrote on X.

"India has 167 dollar billionaires. A 2% wealth tax would raise 1.5 lakh crores each year, about 0.5% of our GDP. This could pay for schools, hospitals, renewable energy, and many more essential investments in the future of our country," Ramesh said, in the run-up to the Union Budget. FM Nirmala Sitharaman will present full Union Budget on July 23, 2024.

Arguments in favor of wealth tax:

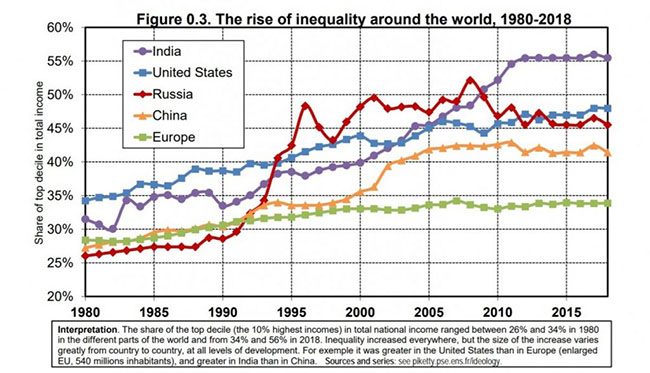

French economist Gabriel Zucman called for an annual 2% levy on fortunes exceeding $ 1 billion. This initiative, he said, could raise $250 billion from about 300 individuals. While raising phenomenally large tax revenues, 99.96% of the adults will not be affected by the proposed tax.

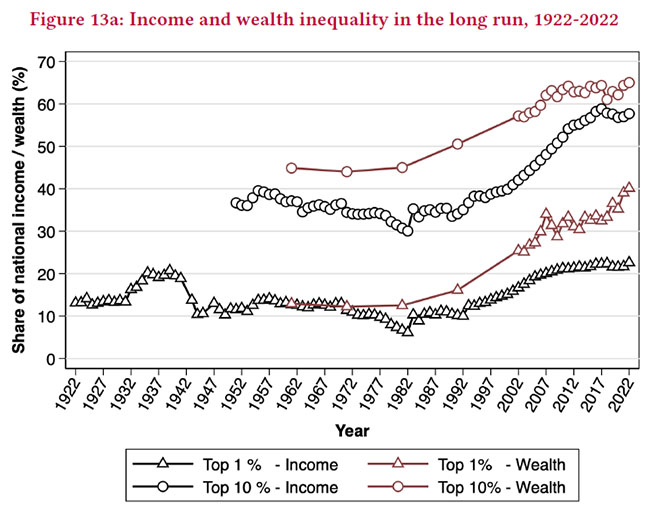

Zucman and fellow economist Thomas Piketty have suggested in their research paper that rising inequality in India must be addressed. Such initiative requires implementing a 2% tax on net wealth above Rs 10 crore and a 33% inheritance tax. According to them, a massive 2.73% of GDP would be raised as tax revenues.

The taxation proposal should be accompanied with explicit redistributive policies which support the poor, lower castes and middle classes. 74% of Indians support taxing wealth. Tax on high incomes and corporations to fund climate initiatives alongside a “polluter pays” approach are strongly advised, say the economists.

In another research paper titled, “Income and wealth Inequality in India 1922-2023: the rise of Billionaire Raj, Thomas Piketty and three of his Indian co-authors compile national income accounts, wealth aggregates, tax tabulations, rich lists, and surveys on income, consumption, and wealth to present long-run homogeneous series of income and wealth inequality in India. Their estimates indicate that inequality declined post-independence until the early 1980s, after which it began rising and has skyrocketed since the early 2000s. By 2022-23, India’s top 1% income share is among the very highest in the world.

Of course, there are arguments against wealth, an alernate proposals for establishing a less unequal soceity. It is a wide subject which requires separate analysis.

National Internal Emergency of 1975:

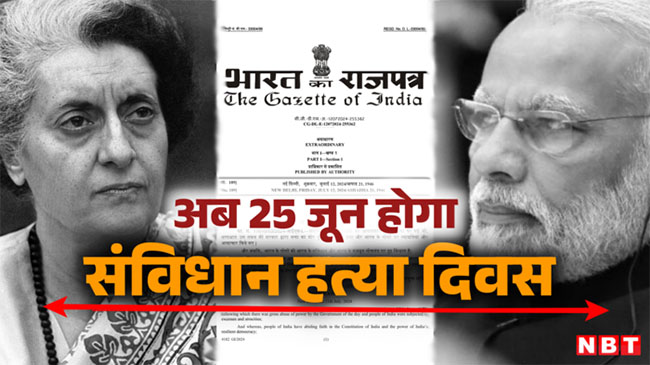

The Modi-led NDA announced to observe June 25 as ’Samvidhan Hatya Diwas’ to mark the 50th anniversary of Emergency. This is its counter to the ‘Save Constitution’ campaign which INC and its partners in INDIA block started against BJP in the build-up to the Lok Sabha polls.

“(It is) a tribute to all those who suffered and fought against the gross misuse of power during the period of Emergency and also recommit people of India to not support in any manner such gross misuse of power in future,” the Union home ministry stated in its gazette notification.

“On 1975 June 25, the then PM Indira Gandhi, in a brazen display of a dictatorial mind-set, strangled the soul of our democracy by imposing Emergency on the nation. Lakhs of people were thrown behind bars for no fault of their own, and the voice of the media was silenced,” HM Amit Shah wrote on X.

Earlier, President Droupadi Murmu, in her address to the joint sitting of Parliament, had made a detailed reference to the Emergency. The LS speaker Om Birla too had read out a statement and asked members to observe a two-minute silence as a tribute to the sufferers of the Emergency.

PM Modi has spoken about it on multiple occasions, including in his customary media address ahead of the Parliament session and also in his reply to the debate on the President’s address.

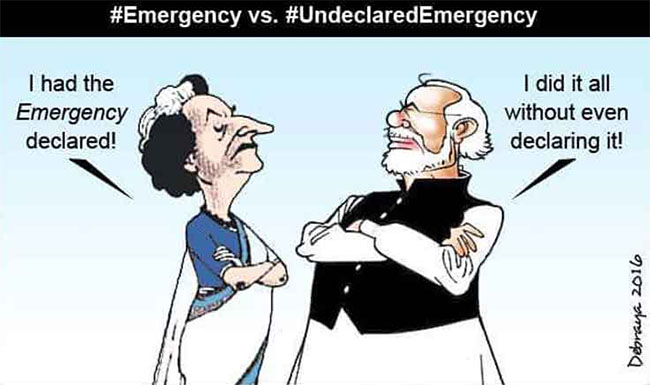

How long will Modi and BJP will beat the dead horse? Indira Gandhi had acknowledged that Emergency was her mistake and she paid for it electorally in 1977. At the same time, she was forgiven and re-elected within two and a half years.

On 1975, July 4, the Supreme Court upheld the Emergency in India. A constitutional challenge was brought against the Emergency before the Supreme Court. In a majority decision, the court upheld the validity of the Emergency on the grounds of internal disturbance. This decision marked a significant moment as the highest court supported the government’s actions.

There are scholastic and dispassionate analysis of the circumstances under which she declared internal emergency around midnight of 1975 June 25. Most suggest that while it was undemocratic but not unconstitutional. The then opposition leaders had openly incited the army and police to disobey the orders of the government. This was incitement for armed mutiny. If the emergency was not declared, there could have been chaos and even assassination of the government leaders including the sitting PM.

The INC slammed the government over its announcement with Jairam Ramesh claiming on X that Modi “imposed an undeclared Emergency for 10 long years before the people of India handed him a decisive personal, political, and moral defeat on 2024 June 4, which will go down in history as Modi Mukti Diwas.” His reference was to the BJP’s inability to surpass the majority mark of 272 in the 543-member LS during the recent elections.

Assembly by-poll results:

In the Assembly by-polls concluded during the week, the INDIA block bagged 10 out of 13 seats that went to polling across seven states, while the BJP won only two seats. The INDIA block interprets its victory as “conquering the web of fear spread by Modi’. Fact is that most of these seats were held by INDIA block and hence only the status quo has prevailed. The INDIA block has managed to hold on to its core voter base.

| Comments on this Article | |

| Renjith, Kerala | Mon, July-15-2024, 8:55 |

| Yes Sir. Need to impose such wealth tax on multi billionaires. It will definitely help to improve the country s development. | |

| Aboobacker Nettikkara, Kerala | Mon, July-15-2024, 9:16 |

| Very timely evaluation and presentation of the present situation socio-economic situation. I feel speeches and actions moves in different ways. How long will beet the dead horse is the phrase of the present action of the rulers. People are not donkeys , they know how things are going. Let us hope and pray | |

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print