Disinvestment: LIC’s mega IPO

By Philip Mudartha

Bellevision Media Network

04 May 2022:

Preface:

The wait is finally over for the investors who were eagerly waiting for India’s biggest public issue, the Life Insurance Company (LIC) initial public offering (IPO). It hits primary markets on Wednesday, 4th May 2022. Government of India (GoI) is offering for sale 3.5% of its equity stake, totaling 22.1crore shares of face value of Rs 10. The (GoI) has fixed the LIC IPO price band at Rs902 to Rs949 per equity share.

Applicants will be able to apply in lots, where one LIC IPO lot comprises 15 LIC shares. An applicant can apply for a minimum of one and a maximum of 14 lots. As a result, the minimum amount required to apply for the LIC IPO is Rs14,235 and maximum Rs199,290.

The LIC IPO has been valued at Rs21,000 crore. The public issue reserved for anchor investors was oversubscribed on May 2. LIC policy holders’ reservation portion will be 10% of offer size, while employees will have 5%. The discount for the policyholders is $s 60 per share. The LIC employees and retail investors get Rs45 discount per share. All other applicants are expected to bid at Rs 949, the upper price band.

The politics over the offer for sale (OFS) Price:

LIC IPO plans were announced in Fiscal Budget 2020. It took two years to prepare LIC change its accounting system to match the listed entities and frame rules.

LIC came into being as a GoI enterprise on the 19th of January, 1956 by an Act of Parliament (The Life Insurance Corporation Act -1956) which nationalized 154 Indian insurance companies, 16 non-Indian companies and 75 provident funds.

The objective was of spreading life insurance much more widely and in particular to the rural areas with a view to reach all insurable persons in the country, providing them adequate financial cover at a reasonable cost.

Since then, it has penetrated the domestic market and is the most trusted Brand. It follows its catch lines "Jindagi Ke Saath Bhi, Jindagi Ke Baad Bhi", "LIC that knows India better" and "Har Pal Aapke Saath" in the true sense.

I quote from its website:

Every day we wake up to the fact that more than 250 million lives are part of our family called LIC.

We are humbled by the magnitude of the responsibility we carry and realize the lives that are associated with us are very valuable indeed. Though this journey started over six decades ago, we are still conscious of the fact that, while insurance may be a business for us, being part of millions of lives every day for the past 65 years has been a process called TRUST.

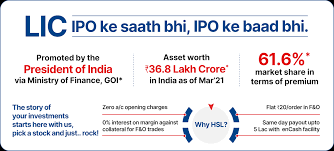

No doubt, LIC is a crown jewel of GoI. Therefore, it should fetch the best price in the market. Since the IPO became the talk of the town, there was much gossip about its issue pricing, size, valuations etc. The GoI mulled raising around Rs. 68,000 crores by divesting 5% stake with the maiden mega IPO at a price tag of around Rs. 2000 per equity share.

Probably GoI lost nerve due to the situation in the global financial markets especially in the wake of on-going Russia-Ukraine War. Hence, GoI pruned its ambitions by scaling down the OFS to 3.5% and the issue price of Rs 949 max.

The Congress party on Tuesday asked the government four pointed questions, alleging that the "confidence and trust of 30 crore policy holders has been valued at throwaway prices".

1. “Why was the LIC valuation of Rs12-14 lakh crores in February 2022 reduced to Rs 6 lakh crores in just two months?”

2. “Why did the Modi government suddenly reduce the ‘valuation of LIC’ and ‘issue size’ after roadshows in India and abroad?” The ?70,000 crore target was reduced to ?21,000 crore after the government conducted roadshows for big ticket investors in February.

3. “Is Modi government ignoring LIC’s key indices?”

4. Public Sector Divestment’s secretary-in-charge had assured that GoI won’t sell stakes in public sector units if the conditions were not favorable. Then why was LIC IPO timed during the Russia-Ukraine War?

LIC’s Indices:

LIC has 61.6% market share in India in terms of premiums and 61.4% market share in terms of New Business Premium. It’s market share 71.8% in terms of the number of individual policies issued and 88.8% market share in terms of a number of group policies issued for the nine months ended December 31, 2021. It is served by 55% of insurance agents in India.

Owing to its enormous agent network, strong track record, immense trust in the brand ’LIC’ and 65 years of lineage, LIC is ranked 5th globally by life insurance. It is ranked 10th globally in terms of total assets.

LIC is the largest asset manager in India as of December 31, 2021, with Assets Under Management (AUM) of Rs. 40,10,000 crores, which is more than 3.2 times the total AUM of all private life insurers in India.

LIC’s has invested heavily in Indian stock market. Its investments in listed equity represented around 4% of the total market capitalization of NSE as on 31st December 2021.

As of December 31, 2021, LIC had 2,048 branch offices and 1,559 satellite offices in India, covering 91% of all districts in India. It has a multi-channel distribution platform for group products comprising its employees in the sales team for group products, individual agents, business partners and alternate channel partners.

The average cost per share to GoI is Rs 0.16 while the IPO price is Rs 949, which is a return on investment over 65 years. However, there are claims that the “embedded value” of LIC is double than what the GoI is selling its stock.

Doubts raised by naysayers:

In the22 years since opening up of insurance sector to private players under the Insurance Regulatory and Development Authority (IRDA) in 2000, LIC has lost 36% of market share. Losing market share to peers is not a positive sign of its future performance.

LIC in past had taken many decisions at the behest of its sole shareholder, GoI, which were not prudent investment decisions. Previously, LIC has bailed out IPOs of Bharat Dynamics Ltd and Hindustan Aeronautics Ltd in 2018. It also bought IDBI Bank, which was reporting losses continuously due to a surge in bad loans. LIC had infused Rs 21,600 crore for 51% stake in IDBI Bank. In 2019, another Rs 4,743 crore was infused in the bank.

LIC does not have strong digital presence. 90% its policies are sold by its agents. Its agent network and rural offices depend on old methods of growing new business. Only 36% premiums were collected digitally while the same figure is 90% for private insurers. If this trend continues, the total cost for LIC is likely to increase.

The new business margin for LIC is low at 9.9% whereas for most private players it is around 25%.

The books show accumulated losses of Rs 6,028 crores which is worrying some analysts. When and how this loss will be adjusted in the future is not addressed as yet.

Should you subscribe?

I polled a dozen friends of mine via WhatsApp if they plan to subscribe. Only one confirmed that he would subscribe while others were not gung-ho about the IPO. There is a general impression that there are unlikely to be short-term gains in the IPO. Only long-term investors may take a bet.

Come May 17th, we will know.

| Comments on this Article | |

| Philip Mudartha, Nerul | Thu, May-26-2022, 7:42 |

| Postscripts: 1. Former Finance Secretary S. C Garg has said that the true worth of LIC the shares of is less than half the issue price. His estimate is between Rs 250 to Rs 450. 2. The contrarian leftist view by V. Shridhar is that the LIC share price should be between Rs. 2,133 and Rs. 2,559. If the current value of the vast real estate assets of LIC were assessed at market prices, the share price should be even higher. LIC IPO is India’s biggest-ever privatization scandal. 3. The lowest stock market price of LIC scrip do far was Rs 803.65. The stock is in a bearish trend. Market pundits predict it to stabilize at around Rs 800. 4. Market is not God, according to those opposed to the privatization of LIC. | |

| Philip Mudartha, Nerul | Tue, May-17-2022, 3:31 |

| LIC shares listed today and traded at discount, closing on NSE at Rs 873. Only 40% were on delivery basis, rest 60% intra-day speculative traders. Expected further decline in coming days | |

| Clarence, Mangalore | Fri, May-13-2022, 10:31 |

| Nice and informative article. Thanks for sharing your views . | |

| Ronald Sabi, Moodubelle | Fri, May-13-2022, 9:42 |

| Loads of information. My opinion is, LIC investment is a big benefit in case of unfortunate loss of life. I have experience on educational policies..., hardly any returns compared to the payments made. Political control over LIC is not a good development. LIC made huge profits over decades, hope there is transparency. I am not fully confident if this investment opportunity is a fortune. Thanks to Philip for the detailed info on origin and health facts of this entity. | |

| Dr Austin Prabhu, Chicago | Wed, May-4-2022, 4:19 |

| Good informative article Sir Philip Mudhartha. Thanks for this information. | |

| Roji Mathew, Pathanamthitta | Wed, May-4-2022, 12:36 |

| Sir,it seems.that LIC will not give massive return in short term, but a slow and steady growth can expect...Nice and informativ article... | |

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print